Possibilities and limits for microbusiness licensing

Be the first to know when new content like this is available!

Subscribe to our newsletter to receive notifications of new posts, local news and industry insights.

Many Thanks! Your submission has been received!

Oops! There was an error submitting the form.

Of all the license types available to cannabis business owners, the Microbusiness License is one of the least issued and discussed. Countless cannabis companies of various sizes are vertically integrated, and many are licensed for multiple activities in the same location. Often times, depending on state and local regulations, licensees choose to grow, process, and sell cannabis from the same business.

Microbusiness licenses are a unique opportunity in the industry, but not without restrictions. While the goal of achieving thriving artisanal cannabis is an ongoing challenge for the industry, constraints on canopy size, production capacity, and business structure can make it difficult for micro-businesses to own.

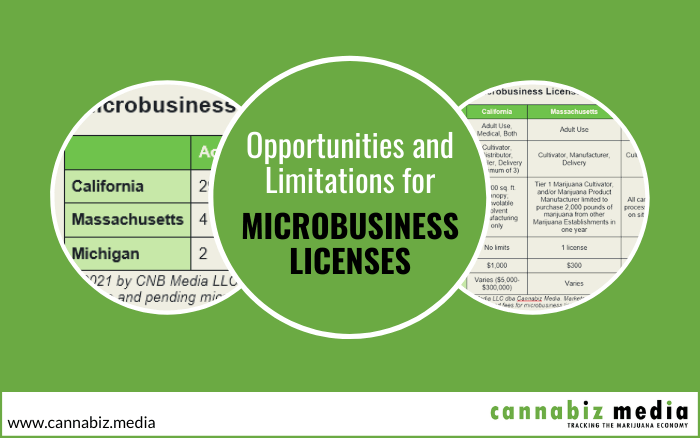

This article examines the possibilities and limitations of micro business licensing in the three markets that currently allow this type of business – California, Massachusetts, and Michigan.

Compared to pharmacy and cultivation licenses, micro-businesses are a relatively new development for the American cannabis industry. Only three states currently accept applications: California, Massachusetts, and Michigan.

California and Massachusetts introduced this new license type after voters approved legalization votes in 2016, followed by Michigan in 2018. This is noteworthy as the Massachusetts and Michigan microbusiness licenses are not viewed as part of the medical cannabis program infrastructure become. California allows micro-medical business licensing – an opportunity in the many communities that remain unfriendly to adult business and sales.

California’s transition from a gray to a licensed market began with attempts to regulate medicinal cannabis (2015) and voter-approved legalization of adult use (2016). Compulsory licensing was introduced in early 2018. At this point in time, some patient collectives and pharmacies decided to acquire a state license as a micro-enterprise with cultivation, manufacturing and / or distribution on site instead of a license as an independent retailer.

As Ed Keating of Cannabiz Media wrote last spring at a Californian micro-company Cannacurio, its activities include limited cultivation and manufacturing, distribution, retailing and delivery. At the time, nearly three-quarters of licenses were allowed to perform three activities – the state minimum – and distribution and manufacturing were among the most common choices.

These small businesses have growing restrictions (10,000 square feet of canopy maximum) as well as manufacturing restrictions (non-volatile solvents only), as shown in the table below. The registration fee is the same as other Bureau of Cannabis Control licenses, while renewal fees vary depending on gross annual sales. Since launch, California has continued to lead the way in micro business licensing, with nearly 300 companies currently in operation.

Elsewhere, Massachusetts and Michigan have slowly adopted the micro-business model with limited license approvals. The numbers for these are low, with Massachusetts giving out four and Michigan giving out two, and Massachusetts has about a dozen more advances in the pipeline.

The data for the Massachusetts approved and pending licenses shows some trends. Twelve micro-enterprises suggested cultivation, manufacturing and retailing. Three have chosen to only do cultivation and retail, and two have chosen only production and retail. All cultivators plan to work indoors.

In terms of inventory transfer, Massachusetts allows products to come from outside sources (other companies) while Michigan allows micro-businesses to function as closed facilities. All cannabis products sold must be grown and grown locally. This is a major departure from California that allows these facilities to distribute cannabis products nationwide through a distribution license.

In addition, Massachusetts does not allow microbusiness license holders to engage in local retail stores. However, delivery will be an option for these operators later in 2021.

Considerations for License Applicants

Clearly, this license type is not suitable for many companies in the industry due to production and sales restrictions. Expanding and emerging multi-state operators (MSOs) are unlikely to pursue a microbusiness application, at least given the current boundaries in some states. Smaller manufacturers who want to limit the complexity of owning multiple licenses may be the best candidates for small businesses.

Since most states’ cannabis regulators require local approval prior to licensing, local objections and concerns about location placement can be an obstacle during the local approval process. Zoning and land use restrictions in some communities may not yet reflect the microbusiness license requirements. Many communities have limited cannabis cultivation and processing, while retailing is permitted in various zoning divisions – which may make some communities unsuitable.

Additionally, operators looking to expand, including multiple locations, can bypass the microbusiness license in favor of more traditional retail and grow facility licenses.

The future of the micro business

Legalization and market expansion have increased since the 2020 elections. Earlier this week, New Jersey crossed the finish line and completed legalization. Micro business will be an opportunity for emerging small operators in the state.

Elsewhere, a legislative proposal in New Mexico could make microbusiness one of the most dominant license types in a future adult market if lawmakers legalize that session.

The microbusiness license could be a new opportunity for small businesses in other states in the coming years.

Post a comment: