Cannacurio No. 96: Q1 2024 License Summary

Be the first to know when new content like this is available!

Subscribe to our newsletter to receive notifications of new posts, local news and industry insights.

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

2023 was a unique year for cannabis licensing. The industry continued its decline, the number of licenses dropped, fewer new licenses were issued, and Oklahoma's moratorium finally went into effect. This post will examine how things changed in the first quarter of 2024 and what the next few quarters might bring.

Since the beginning of the year, several states have taken action to supplement, expand or restrict their programs:

- Ohio – The legislature has approved rules that allow adult use to begin in June, rather than through a dual license

- New Hampshire – Lawmakers recently approved a proposal that would limit the number of retail locations to no more than 15 state-controlled franchise locations across the state and also allow for municipal exemptions.

- North Carolina – The Cherokee Indian tribe opened a pharmacy on tribal land

- new York – The Cannabis Control Office was reformed and work began on closing down illegal businesses.

- Virginia – Governor Youngkin vetoed a marijuana market bill

These five examples prove that cannabis licensing is still a plan-your-own-adventure opportunity. Regulators and governors are being very creative when it comes to finding new ways to structure programs. Below, we outline the changes to some key license types across the country.

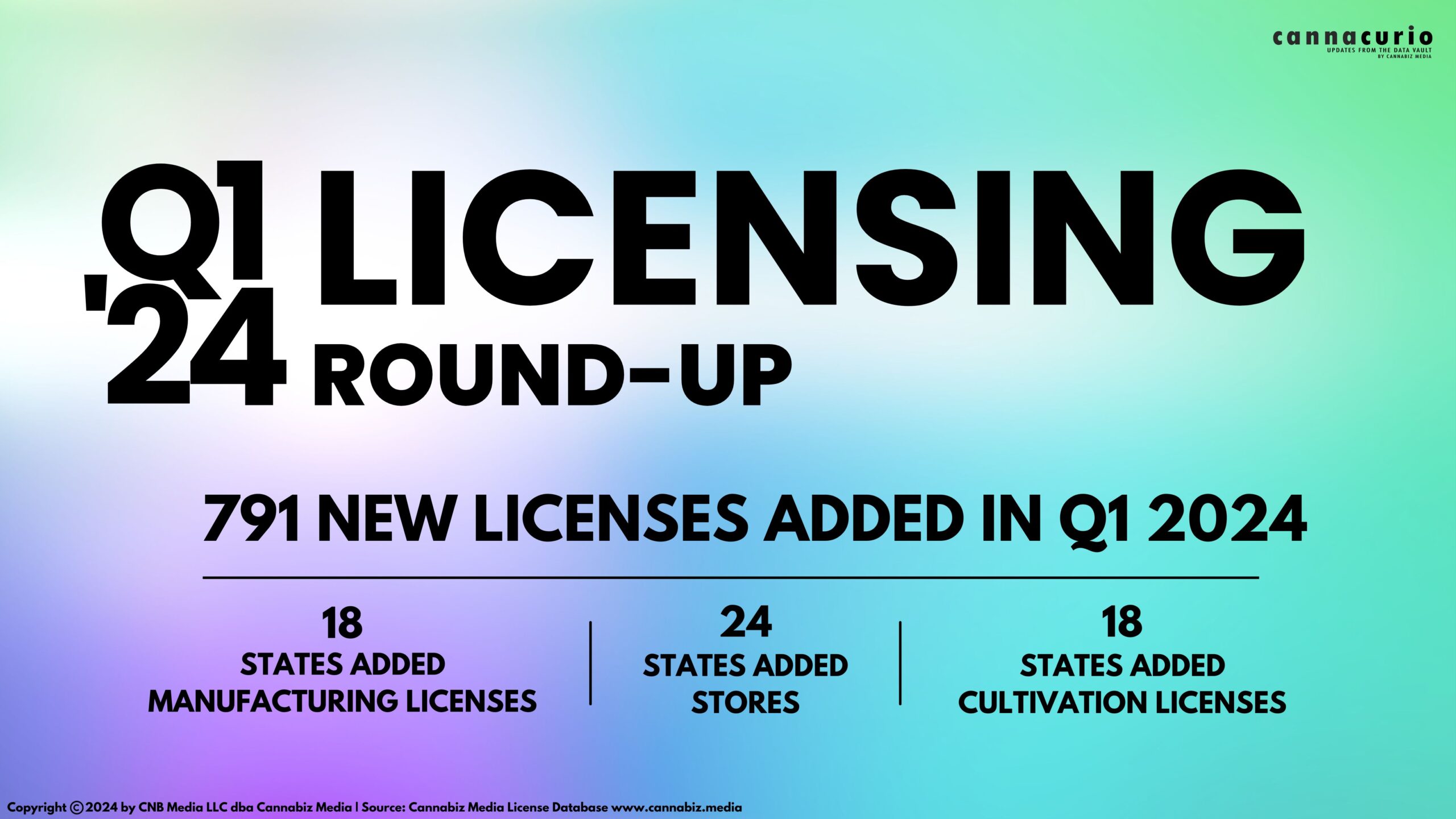

- In the first quarter of 2024, 791 new cultivation, manufacturing and trade licenses were issued, compared to 1,691 in the first quarter of 2023 – a decrease of 51%.

- 24 states have added new stores, 18 new manufacturing licenses and 18 new cultivation licenses.

- In total The number of active licenses decreased by 2.1% in the quarter: cultivation -4.3%, production -1.23% and distribution/retail +0.8%.

The strangest thing about the data is that the ratio of new licenses issued for cultivation, manufacturing and retail is exactly the same as it was a year ago. This could be a coincidence, or we have discovered some kind of golden ratio in licensing. In the first quarter of 2023 and 2024, retail licenses accounted for 42% of new licenses, cultivation was second at 37%, and manufacturing was third at 21%.

Below we can see that the number of stores and manufacturers increased throughout the quarter, with more and more stores opening.

Here is a summary of the three main license types in the value chain.

Shops

- 333 new store licenses were issued in the quarter, compared to 699 in the previous year

- 60% of these licenses were in 4 states: New Jersey, Michigan, New Mexico and New York

- Oklahoma accounted for 1.2% of new licenses, compared to 47% last year.

Cultivation

- Regulators issued only 289 cultivation licenses in the first quarter, slightly more than in the fourth quarter of 2023 (277).

- California, Michigan and New Jersey accounted for 66% of new cultivation licenses.

- Licensing moratoriums apply in several major producing countries

The table below shows the quarterly breakdown of new cultivation licenses issued this year for the top five states by month. California and Michigan have been at the top of this ranking for years, along with Oklahoma. The full list of issuing states can be found on our Cannabis Market Intelligence Platform www.cannabiz.media.

Manufacturing

- In the first quarter, 169 new manufacturing licenses were granted

- New Mexico led the way, issuing 61 licenses (36%)

- The total number of manufacturers remained stable at 6,013, down slightly from 6,085 at the end of the year.

As with other activities, most new licenses were issued by a handful of states. 5 states issued 76% of all new licenses. New Mexico, New Jersey, Michigan, California and Arizona topped the list. The chart below shows states that issued at least 10 new manufacturing licenses last year.

The graph below includes the number of active licenses for all of the activity we track in terms of active establishments. We consider a establishment to be a location that has multiple licenses owned by a single company. These are relevant for tracking cultivation licenses in California, where a grower may have many small licenses on one farm. The same is true for states where a business must have both a dispensary and retail license – this counts as one establishment.

There has been a slight decline in licenses and facilities over the past 12 months. Looking at each state in detail, much of the decline is due to deflation in Oklahoma. However, with the introduction of new and expanded programs, we could see an uptick in these areas.

Ed Keating is the co-founder of Cannabiz Media and oversees the company's data research and government relations. He has spent his career working with and advising information companies on compliance. Ed has led product, marketing and sales while overseeing complex, multi-jurisdictional product lines in the securities, corporate, UCC, security, environmental and human resources sectors.

At Cannabiz Media, Ed enjoys the challenge of working with regulators around the world as he and his team gather corporate, financial and licensing information to track the people, products and companies in the cannabis economy.

Ed graduated from Hamilton College and received his MBA from the Kellogg School of Northwestern University

Cannabiz Media clients can stay up to date on these and other new licenses through our newsletters, alerts and reporting modules. Subscribe to our newsletter to receive these weekly reports in your inbox. Or you can schedule a demo to get more information on how you can access the Cannabis Market Intelligence Platform yourself to dive deeper into this data.

Cannacurio is a Cannabiz Media column featuring insights from the most comprehensive cannabis market intelligence platform. Stay up to date with the latest updates and information through Cannacurio's posts and podcasts.

Post a comment: