Cannacurio No. 89: Year-end 2023 best list in the manufacturing sector

Be the first to know when new content like this becomes available!

Subscribe to our newsletter to receive notifications of new posts, local news and industry insights.

Thank you very much! Your submission has been received!

Oops! An error occurred while submitting the form.

In the last of our 2023 licensing reviews, we turn to manufacturing, the least volatile of the three areas we cover. At Cannabiz Media, we classify a manufacturer as a licensee who processes marijuana-infused products such as edibles or concentrates, but does not grow or sell them to customers (flower in, product out). Cannabis production licenses are issued more slowly than cultivation or retail licenses.

However, they represent an important asset for companies because the products are often strong brands. Unlike licensed assets, these brands can cross state borders and help established companies succeed and expand market share. They are also useful for the license holder as these facilities can be used for white label production, increasing the value of the asset.

- In 2023, 744 new manufacturing licenses were granted, compared to 1,398 in 2022 (-46%).

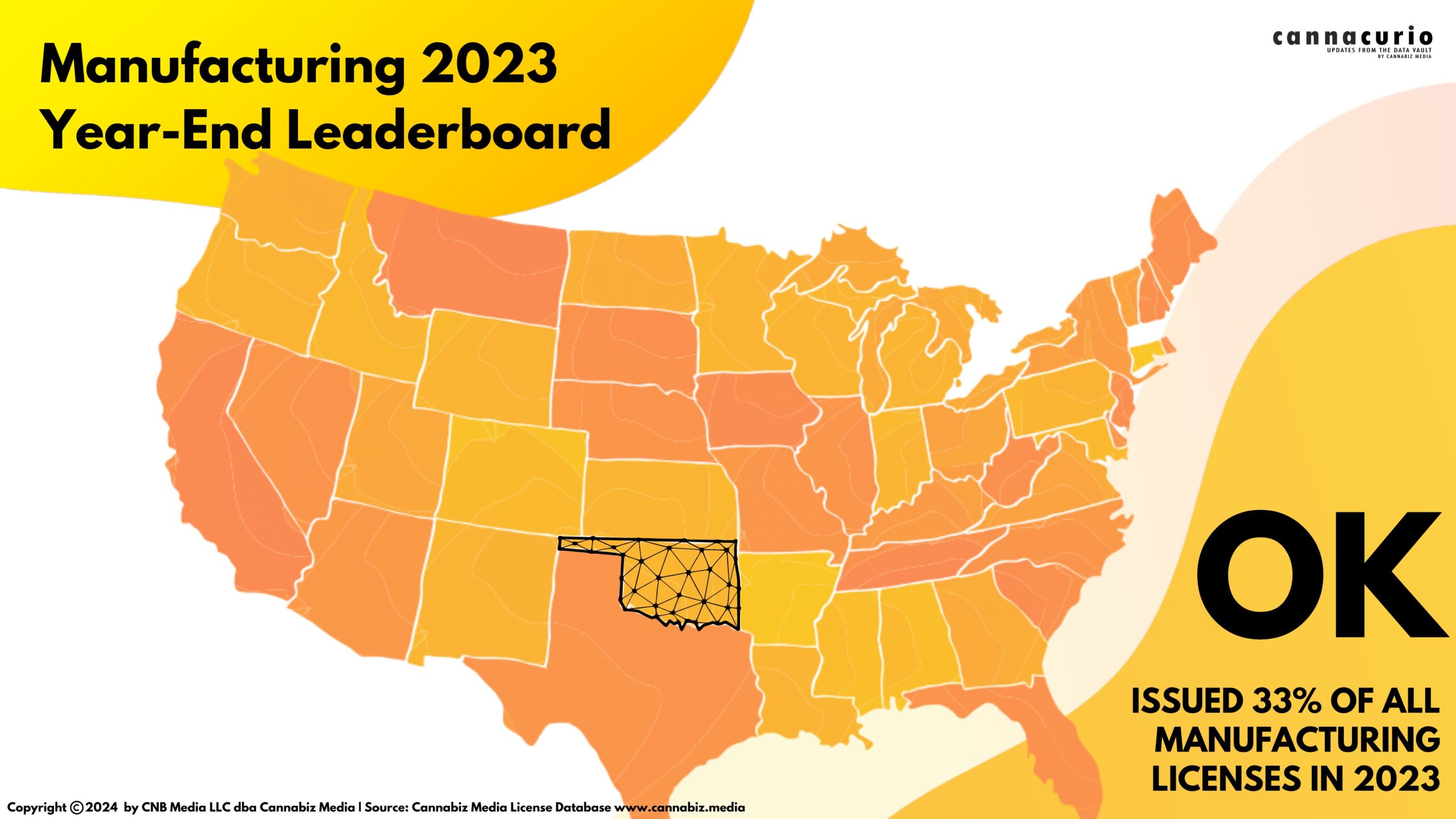

- Oklahoma led the way, issuing 246 licenses (33%), and Michigan was a distant second with 96 (13.3%).

- The number of manufacturers remained largely stable at 6,085, only 0.03% more than in the previous year.

As we see with other activity, most new licenses were issued by a handful of states. Five states issued 71% of all new licenses, compared to 85% last year. Oklahoma, Michigan, New Jersey, Washington and California topped the leaderboard. The chart below shows states that issued at least 10 new manufacturing licenses last year. The table shows all states.

Here is the ranking showing total manufacturing licenses by state for year-end 2023. It is practically unchanged compared to the previous year:

Again, manufacturing licenses remain the least volatile activity in terms of the number of licenses. The overall year-over-year difference was a net gain of just 22 licenses. In addition, only 744 were added, a third of which came from Oklahoma. However, when the Sooner State's moratorium went into effect, the number of new OK licenses fell to 11 in the final nine months of the year. With the extension of the moratorium and increased scrutiny from regulators and law enforcement, we will likely see an overall decline in 2024 experience.

Ed Keating is co-founder of Cannabiz Media and oversees the company's data research and government relations. Throughout his career, he has worked with and advised information companies in the compliance area. Ed has led product, marketing and sales while overseeing complex, multi-country product lines in securities, corporate, UCC, security, environmental and human resources.

At Cannabiz Media, Ed enjoys the challenge of working with regulators around the world as he and his team collect corporate, financial and licensing information to track the people, products and companies in the cannabis economy.

Ed graduated from Hamilton College and received his MBA from the Kellogg School of Northwestern University.

Cannabiz Media customers can stay up to date on these and other new licenses through our newsletter, alerts and reporting modules. Subscribe to our newsletter to receive these weekly reports straight to your inbox. Or you can schedule a demo to get more information about how you can access the Cannabis Market Intelligence Platform yourself and dive deeper into this data.

Cannacurio is a weekly column from Cannabiz Media featuring insights from the most comprehensive cannabis market intelligence platform. Check out Cannacurio posts and podcasts for the latest updates and information.

Post a comment: