Cannacurio No. 105: Manufacturing Ranking 2024 Q3

Be the first to know when new content like this becomes available!

Subscribe to our newsletter to receive notifications of new posts, local news and industry insights.

Thank you very much! Your submission has been received!

Oops! An error occurred while submitting the form.

background

In the final roundup of our third quarter licensing, we turn to manufacturing, the least volatile of the three activities we cover in these quarterly posts. At Cannabiz Media, we classify a manufacturer as a licensee who processes marijuana-infused products such as edibles or concentrates, but does not grow or sell them to customers (flower in, product out). Cannabis production licenses are issued more slowly than cultivation or retail licenses.

However, they represent an important asset for companies because the products are often strong brands. Unlike licensed assets, these brands can cross state borders and help established companies succeed and expand market share. They are also useful for the license holder as these facilities can be used for white label production, increasing the value of the asset.

Key findings

- 268 new manufacturing licenses were issued in the third quarter, compared to 202 in the second quarter

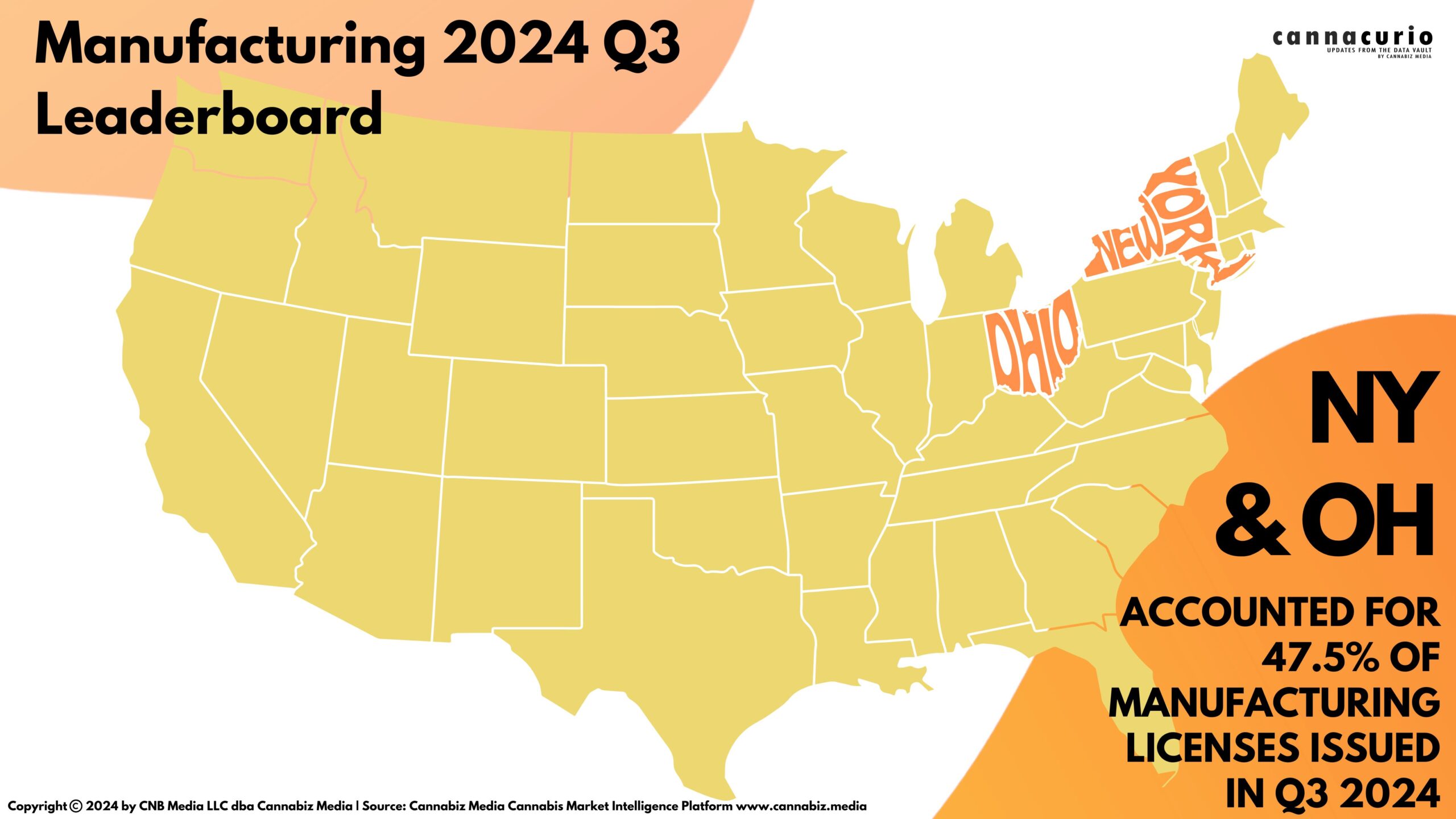

- New York led the way, issuing 72 licenses (27%), followed by Ohio with 55 (20.5%).

- 19 states issued licenses this quarter, up from 15 in the second quarter

- The total number of manufacturers remained stable at 5,941, up slightly from 5,912 at the end of the first quarter

As we see with other activity, most new licenses were issued by a handful of states. 5 states issued 68% of all new licenses. New York, Ohio, Michigan, Colorado and New Jersey topped the leaderboard. The chart below shows states that issued at least 10 new manufacturing licenses in the last quarter.

The full list of issuing states can be found on our Cannabis Market Intelligence platform www.cannabiz.media.

Cannabiz Media tracks both facilities and licenses. A facility has more than one license at a given location. This happens most often with cultivation licenses – particularly in California and with operations in states like Colorado, Illinois and Michigan. Production licenses and facilities have continued to develop accurately and in a tight band over the past 12 months.

Leaderboards

Here is the ranking of total production licenses for the top 10 states for the third quarter of 2024.

Diploma

Again, manufacturing licenses remain the least volatile activity in terms of the number of licenses. It's still astonishing that Oklahoma has 982 production licenses – considering the state's population is only about 4 million. I assume that not all of these licenses are valid.

author

Ed Keating is co-founder of Cannabiz Media and oversees the company's data research and government relations. Throughout his career, he has worked with and advised information companies in the compliance area. Ed has led product, marketing and sales while overseeing complex, multi-country product lines in securities, corporate, UCC, security, environmental and human resources.

At Cannabiz Media, Ed enjoys the challenge of working with regulators around the world as he and his team collect corporate, financial and licensing information to track the people, products and companies in the cannabis economy.

Ed graduated from Hamilton College and received his MBA from the Kellogg School of Northwestern University.

Cannabiz Media customers can stay up to date on these and other new licenses through our newsletter, alerts and reporting modules. Subscribe to our newsletter to receive these weekly reports straight to your inbox. Or you can schedule a demo to get more information about how you can access the Cannabis Market Intelligence Platform yourself and dive deeper into this data.

Cannacurio is a Cannabiz Media column featuring insights from the most comprehensive cannabis market intelligence platform. Check out Cannacurio posts and podcasts for the latest updates and information.

Post a comment: