Two US senators have merged with prohibitionists to block the tax relief of 280e for cannabis companies

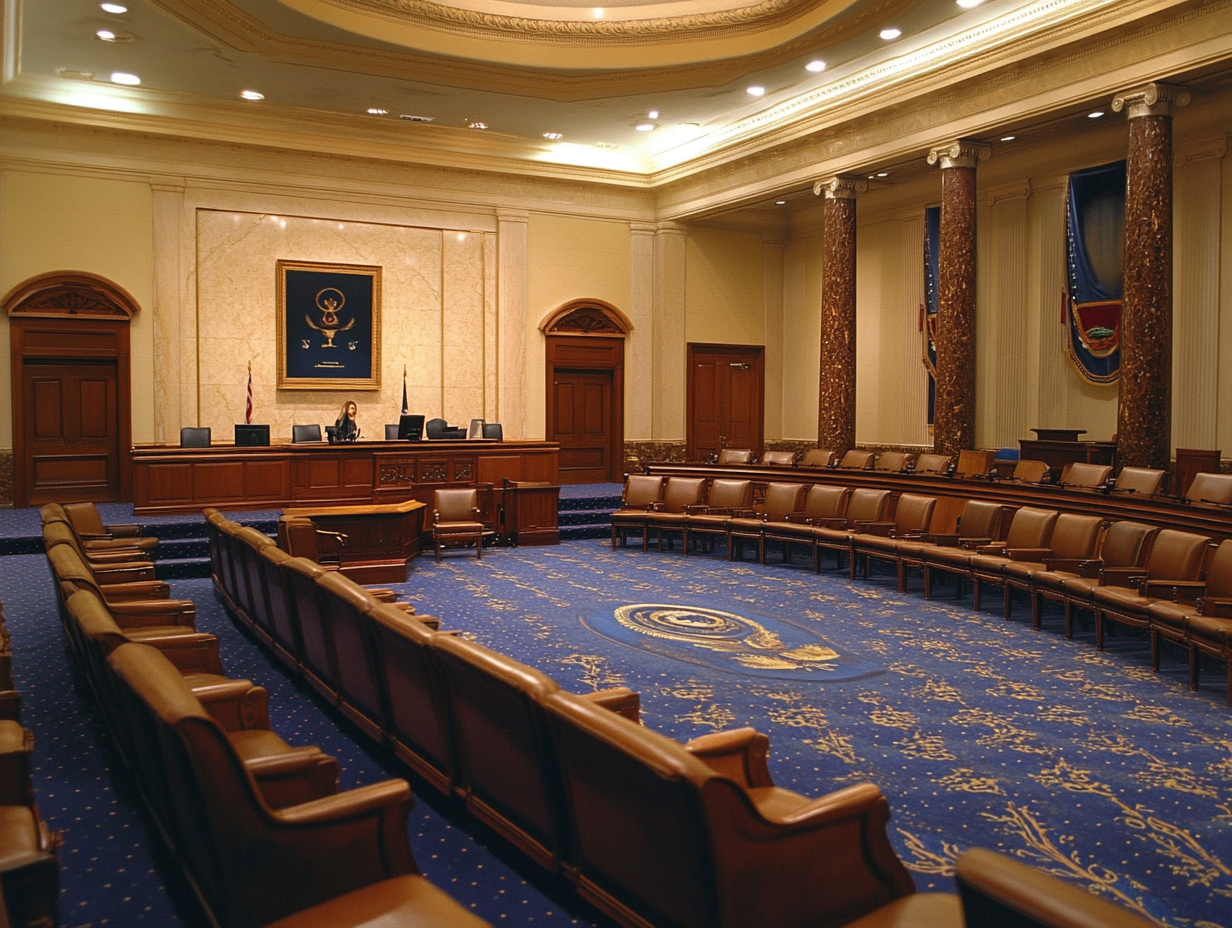

Just when the cannabis industry believed that tax relief was on the horizon, two US sensors throw a wrench on the plan. Senatorers James Lankford (R-OK) and Pete Ricketts (Rn) have teamed up with prohibitionist groups to oppose the efforts Lift the 280e tax law Under the upcoming Cannabis in -house planning.

For those who are unknown 280e is a control rule This prevents cannabi companies from copying standard costs such as rent, salary statements and marketing – something that legal companies can do without problems. Since marijuana is illegal, even state-licensed cannabi operators Pay taxes to a much higher sentenceWhat companies that have already struggled with oversupply and price waste are pressed.

The struggle for the rescheduling and tax relief

The pressure after Move cannabis from Appendix I to Appendix III Would bring urgently needed tax reliefs to the industries. Schedule III substances, such as certain prescription drugs, are not exposed to 280e– That is why many cannabis companies have supported the shift.

But prohibitionist groups, which are supported by Lankford and Ricketts, are committed to this tax relief. Your argument? You claim the The bidges management uses the rescheduling as a “back door” for full legalization And be worried that it will weaken the federal control over cannabis.

What does this mean for the industry

If Cannabis remains in a legal floating– Regulated by states, but like an illegal medication at the federal level – many companies were able to have difficulty staying over water. The industry pushes back and argues that When the government recognizes medical advantages of cannabis (As Annex III suggests) then companies should be taxed fairly.

With 2024 elections are dismissedThe cannabis industry and the political decision -makers are preparing for this A great struggle for taxes, regulations and the future of the federal government of the federal government.

Post a comment: