The price of Massachusetts weed has fallen by half. Here’s why

David Rabinovitz recently visited his local retailer in Massachusetts. He bought two-eighths of flowers and was immediately struck by the price. A product that used to cost $60 an eighth was $31.25 after a discount.

Like everyone else, Rabinowitz loves bargains. But as a cannabis industry veteran who has worked for many years in business planning, business structuring and other corporate functions, he was also dismayed.

New growers are flooding the market with offers and there’s no end in sight.

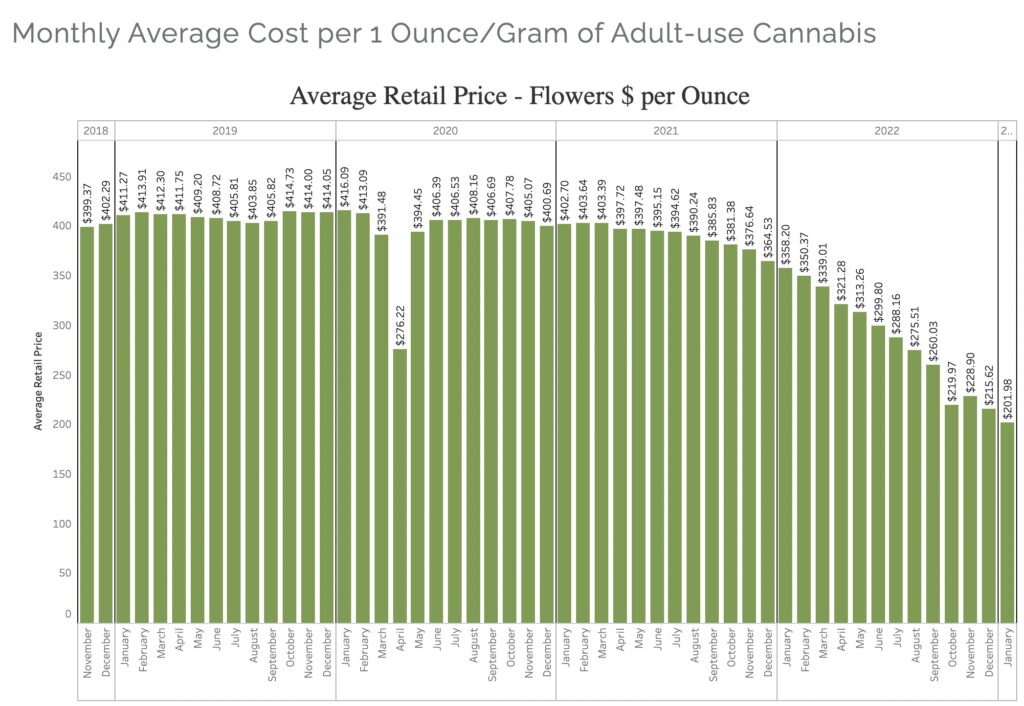

Cannabis prices in Massachusetts are in free fall. After hitting $403 an ounce in March 2021, prices have fallen steadily for two straight years, hitting an all-time low of $202 an ounce in January — and many, including Rabinovitz, believe they haven’t bottomed out yet .

Here’s what it looks like in a chart released by the Massachusetts Cannabis Control Commission:

What about it?

An obvious explanation is found on the first page of every economics textbook: supply exceeds demand. It’s an experience that Oregon and California struggled with, and now it looks like it’s arrived in Massachusetts.

To understand how this happened — and why it’s a problem expected to get worse — rewind to 2018, when Massachusetts transitioned from a purely medical market to a recreational industry.

At that time there was little infrastructure for such a pivot. Setting up indoor grow operations—from permitting to building to actually growing—takes a couple of years. That’s a lot longer than it takes to open a store. At the same time, Massachusetts was the only Northeastern state to open up for recreation, bringing high domestic and foreign demand to those early storefronts. It was a formula for rising prices.

Good news for consumers, bad news for farmers and retailers.

Those high prices attracted investors eager to jump in and fund more grow operations, some of which are now coming online. The only limit the state has imposed on the cultivation license is the size of the operation – 100,000 square feet per license.

“It only takes about a dozen people with the same idea to set up a 50,000-square-foot, 100,000-square-foot canopy grow area,” says Brendan Pollock, CEO of Theory Wellness, which operates retail locations in Massachusetts, Maine, and Vermont. “And as soon as these came online, they weren’t really needed anymore and they really flooded the market.”

Shop highly rated pharmacies in your area

Shows you pharmacies near New York, NY

Show all pharmacies

There could be a lot more supply on the way

And here we are.

As of December 8, 2022, 95 cultivators were in operation and licensed for 2.1 to 2.86 million square feet of canopy. Behind are 24 final licenses that have been approved for an additional 570,000 to 765,000 square feet of canopy (over half of those licenses are Tiers 1, 2 or 3), while 180 provisional licensees are seeking approval for 3.6 to 4.975 million square feet of canopy. That’s a lot of potential offerings in the pipeline.

“It was quite a dramatic shift from a very expensive, underserved market,” says Pollock. “That created this artificial bottleneck in the beginning.” Now, he says, “we kind of tipped the other way.”

Too many cultivation licenses?

Unfortunately, Rabinovitz says things are likely to get a lot worse — and there’s plenty of blame for that. This flood of products? Most people have no idea how many flowers are in the pipeline now, he says — in large part because regulators in Massachusetts haven’t disseminated such information and haven’t cut licensing even as the current dilemma began to unfold.

“So they allow people to keep growing,” Rabinovitz says. “And the fundamental problem is that people don’t understand the market. They don’t do research before going to market. And the regulator doesn’t regulate the market and doesn’t provide the market with the right information. So everyone just keeps plowing.”

Farmers chase falling wholesale prices

Giannone saw this coming too, which is why Trade Roots waived a special permit that would have allowed the company to double the size of its growth. About six months ago, his board of directors authorized him to take to social media and alerted the industry, but at the time nobody would listen and instead referred to him as “Calamity Carl.” He’s not optimistic now; He had a conversation with a multi-state operator whose only concern was market share. “They’ll just run downstairs,” he says.

Adding to the state’s troubles, Massachusetts is no longer the only game in town. Three neighboring states – Maine, Rhode Island and Vermont – now sell recreational products. Connecticut and New York have also opened their recreational markets.

Most of the state’s crop is grown indoors

Whenever the federal government gets around to lifting the ban on interstate commerce, all Massachusetts producers will have to trade off their product, which is grown in expensive indoor facilities, against comparatively cheap acreage elsewhere. “Once these walls come down,” says Rabinovitz, “prices will not go up again. Prices will continue to fall.”

As a result, many indoor grow facilities could become albatrosses. “The cultivators have the most expensive facilities, they take the longest to assemble, and they have the shortest lifespan because their economic life will end soon after you can ship [cannabis] across national borders,” says Rabinovitz. “No one seems to want to believe that.”

Planning for a smallholder, high-quality future

Despite all of this, more acreage is now being built in Massachusetts — a fact that Pollock says is “unfortunately going to cause a lot of pain for people who are just trying to get in now.”

Pollock says Theory Wellness plans to focus on small, high-quality operations to avoid being stuck with large-scale grows over the long term. The company was on the verge of moving forward with a new manufacturing facility in Massachusetts last year and pulled the plug over market concerns. “We’re really glad we did that at this point,” says Pollock. “So we’re really focused on building the best brands that we can and building that brand loyalty as things get more competitive. I think this is our best course forward in the long run.”

Post a comment: