How do I get money for a cannabis business?

This article is the fifth in a series entitled: “So do you want to start a canna business?” created in partnership with Good Tree Capital. This article focuses on getting cash to start your cannabis business.

Funding is the main barrier to entry into the cannabis industry. Hence, it is important to structure your approach to overcoming this challenge as a challenge. It doesn’t matter if you’re a corner bodega, a chain restaurant, a cannabis grower, or one of the big four tech companies, there are really only three ways to fund the growth of a business:

- Reinvest profits from running your business

- Take out debt from a lender

- Selling a stake in your company to an investor.

Before that, we briefly discussed each funding method. Now it’s time to explore more.

Profit, Debt or Equity?

Before reading any further, you should be clear about where your business is and what you can afford.

- Has your company already made a profit? Companies do Profits when the income from sales exceeds the cost of generating those sales.

- Or do you have to use debt? fault It usually comes in the form of credit cards or loans to the company and has to be repaid.

- Your third option is equity. Equity The financing does not have to be repaid. Companies add equity when they sell a percentage of the property to an outside investor.

If your business is up and running and you are making a profit then congratulations! You seem to have a good thing. We’ll continue to focus on how new or existing cannabis companies should think about raising debt or equity, or both, and getting back to profitable businesses by the end of this article.

With the federal ban on cannabis, the supply of debt and equity is severely restricted. Most banks aren’t even willing to provide bank accounts, let alone credit cards or loans, to cannabis licensees to help them run their businesses.

connected

How much does it cost to start a cannabis business?

The availability of equity funds is also limited. Private equity investors, including venture capitalists and angel investors, are often constrained by stigma or situational social governance guidelines that prohibit them from investing in cannabis.

When supply is low and demand is high, prices go up. Low-risk cannabis companies seeking credit often pay more than 25% APR on loans that comparatively risky non-cannabis companies would cost a quarter of that amount.

How do I get a Canna Biz loan

You can avoid predatory loans by first assessing the strength of your candidacy for a loan or loan yourself. Someone who lends you money and expects it back is looking to see if you are making enough monthly sales to make monthly loan payments and if you have consistently met your commitments in the past.

You will also want to see business or personal assets that can be confiscated to reclaim the value of the loan if you fail to make your monthly payments.

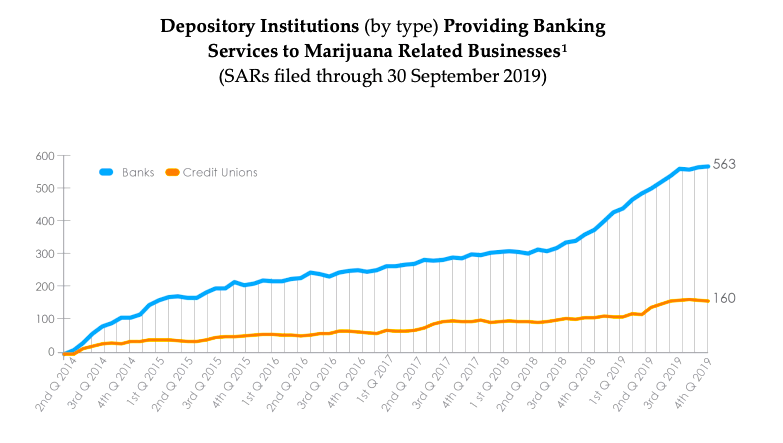

The Small Business Administration offers a useful section to find the best possible loan case. While the SBA does not lend to cannabis companies, the Financial Crimes Enforcement Network (FinCen) reported that 723 banks and credit unions (6% of the total) across the country provided banking services to cannabis companies in 2019.

FinCen has stopped publicly reporting which banks and credit unions filed with them. So, if you want to know which banks and credit unions in your state offer services to cannabis companies, we recommend filing a Freedom of Information Act filing with FinCen to disclose applicants.

Other sources of capital for a cannabis business

Development fund

Another source of profitable capital is an innovative model from Illinois. With the legalization of adult cannabis, the state has also set up a US $ 30 million Cannabis Business Development Fund to provide low-interest loans to state social justice licensees.

The aim was to ensure that individuals from disproportionately affected communities had a source of capital to stimulate and grow their businesses, and that they were treated as equals with deep-pocketed multi-state operators. Washington, Colorado, and a number of other states are considering similar programs.

The portrait you paint for a bank lender or government agency should be the same portrait you paint for more informal lenders like your mom or dad, your ex-boss, your business partner, or your wealthy uncle.

friends and family

We encourage you to look beyond institutional financiers and deal with people who believe in your business plan. It is advisable to rely on family and friends to provide you with credit (especially at an early stage), with the benefit of fully understanding and appreciating the risk of lending your business money.

In fact, a common misconception in equity financing is that the only viable investors come from multi-million dollar venture capital firms. The reality is that most companies’ early stock investors are usually made up of supportive family members and friends.

While a huge influx from an investment group is great, it is equally effective to get investments from colleagues and like-minded people who believe in your idea and want to support what you are building.

Determination of the holdings

While debt investors use capital for an immediate return, equity investors don’t look for a short-term payback. The goal of a stock investor is to help your business grow so that its investment increases in value as your business matures.

Having an interest in a company essentially means owning part of the business, and these stakeholders are usually involved in it in the long run, assuming that their investment will make the business successful.

connected

Cannabis Business Models 101

New business owners run the risk of grossly overvaluing their business as well as severely undervaluing their business. Overvaluing your company discourages sensible investors and those who believe your company is too expensive. Undervaluing your company can cause you to lose the majority or lose control of your company in the long run.

Before selling a piece of your business to someone, it is important to determine the valuation of your business. The only way to know how much an investment is worth is to look at it in the context of the overall value of the business.

Ways to determine the value of your business include:

| method | function |

|---|---|

| Use the sum of your expected costs to start your business | For pre-operational companies, you can see all costs that are incurred for commissioning. Investors’ equity will be proportional to the percentage of the cost their capital covers. |

| Calculate the value of all assets | Add up the value of everything your business owns (license, inventory, real estate), then subtract any debt or liability (loans, liabilities, taxes). |

| Use an annual sales valuation multiplier | First, determine your annual sales and then a multiple to determine how much your business model can be worth for a given level of sales. Find multipliers based on similar sales, growth, and valuation metrics for cannabis companies |

| Make use of your price-performance ratio | Estimate your value for money to determine your worth based on your projected annual earnings |

| Do a discounted cash flow analysis | Discounted cash flow analysis is a forecast for the future based on a company’s annual cash flow. Use a present value calculator to do this. |

When you successfully use debt and equity to fund your business, you can unlock the third type of financing mentioned above – profits.

The ultimate goal of all businesses is profitability. After a few years of stable business activity, the profits your company makes can be reinvested in the company.

Once growth and development are supported by the money the company generates from operations, the company becomes truly profitable and is able to scale and expand.

By submitting this form, you are subscribed to Leafly news and promotional emails and agree to Leafly’s Terms of Use and Privacy Policy. You can unsubscribe from Leafly email messages at any time.

Post a comment: