Federally illegal marijuana brought in nearly $4,000,000,000 in tax revenue in 2021, but how can that be when it’s illegal?

Nearly $4 Billion Taken In Cannabis Tax Revenue By States In 2021 – How Are States Using That Money?

A new report from the Marijuana Policy Project (MPP) revealed that states that legalized recreational marijuana generated over $3.7 billion in tax revenue last year alone, a 34% increase over revenue represents that the states took in the previous year.

According to MPP President Toi Hutchinson, the report is “further evidence that ending cannabis prohibition offers tremendous financial benefits for state governments.”

“The legalization and regulation of adult-use cannabis has generated billions in tax revenues, funded vital state-level services and programs, and created thousands of jobs across the country,” she said in a press release. “Meanwhile, states that are lagging behind continue to squander government resources enforcing archaic cannabis laws that harm far too many Americans.”

States that have collected tax revenue from the sale of adult-use cannabis have allocated the money to many programs and services that benefit the local community. Examples include building schools, education, public libraries, early literacy, preventing bullying, drug and alcohol treatment, and more. There are now 18 states that have legalized adult use of cannabis for Americans 21 and older; In addition, 8 laws have been passed in the last 2 or 3 years, but tax and sales collections have not yet started in 6 of these states.

However, only 4 out of 11 states that started collecting adult sales taxes as early as 2021 (Colorado, California, Massachusetts, and Illinois) have allocated money to equity and restorative justice programs. Illinois provided the most of them all, spending nearly a quarter of its cannabis tax revenue on these programs.

Here’s what some of the top states have been doing with their cannabis tax revenues:

California: $1,294,632,799

California gave the green light to the proposition legalizing adult use of cannabis back in 2016. The law was hopeful for voters who believed it could reverse the damage caused by the drugs of war while generating revenue from programs that would help the community, such as youth programs, public health, environmental restoration, and drug abuse prevention.

Since then, California has always had record-breaking cannabis sales, even during the coronavirus pandemic. In terms of spending their tax revenues, California has allocated funds to help solve the problems caused by cannabis arrests and has also contributed money to police departments, reports NBC News.

Last year, in June, they announced they had awarded approximately $29 million in tax revenue grants to 58 nonprofit organizations dedicated to repairing the damage caused by the War on Drugs, through the California Community Reinvestments Grants program.

The nonprofits also support programs that help with job placement, substance abuse treatment, mental health and legal counseling for disproportionately affected communities.

Illinois: $424,206,703

Illinois is notorious for its high taxes and prices, but that hasn’t stopped people from buying their cannabis. In January 2020, Illinois legalized the sale of adult products and has consistently had record-breaking product sales ever since.

As a result, they are among the highest revenue streams for cannabis taxes. According to the Sun Times, $134.1 million will help subsidize two projects designed to help communities hardest hit by the war on drugs, as well as fund drug treatment and mental health programs. A similarly large portion will go to general budget and state stabilization, while over $60 million will go toward paying administrative expenses, cannabis elimination programs, funding local government, drug abuse education, and research into the effects of the legalization of cannabis.

Funding also went to the Restore, Reinvest, and Renew (R3) program, which was created as part of the legalization of adult use, a law that requires 25% of cannabis tax dollars to be dedicated to this program disadvantaged communities have access to services such as community re-entry, youth development, legal aid and financial support.

Washington: $630,863,570

Adult cannabis has been legal in Washington state since 2012 with the passage of the 502 Initiative. They are one of the pioneers of cannabis legalization and one of the first two states to legalize adult-use marijuana, along with Colorado.

Most of the legal cannabis tax revenue goes to, in order: the general government fund, basic health programs, local governments, the Washington State Health Care Authority, the Department of Health, the Washington State Patrol, the Washington Liquor and Cannabis Board, and others.

Additionally, nearly half of all cannabis tax receipts in fiscal years 2015-2021 were allocated to the Basic Health Plan escrow account, reports the Washington State Treasurer’s website. According to them, this account “provides necessary basic health services for employed persons and others who do not have insurance coverage at a cost to those persons that does not constitute a barrier to obtaining necessary health services”.

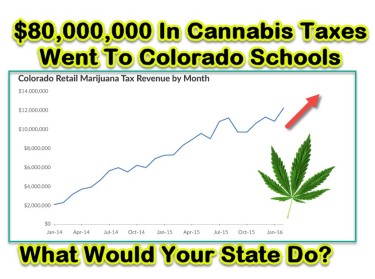

Colorado: $396,157,005

Recreational cannabis has been legal in Colorado since 2014 and medical marijuana since 2000 with the passage of Colorado Amendment 64. They were the first state in the country to legalize medical marijuana at all.

Recreational sales taxes go to the state general fund, while a portion of it goes to the Department of Education’s State Public School Fund. The rest goes to the Marijuana Tax Cash Fund, which funds educational programs. In addition, lawmakers have set aside about $25 million for school districts to set up all-day kindergarten programs, the Colorado Sun reports. A portion of the taxes also helps the Colorado Department of Agriculture pay for costs associated with the hemp regulation and seed certification program.

And that’s a summary of how some of the nation’s top cannabis sales tax earners are spending their dollars. Are you happy with how your state is using yours?

CANNABIS TAX REVENUE, READ MORE…

WHAT DOES COLORADO SPEND ITS CANNABIS TAX REVENUE ON?

OR..

OVER $10 BILLION IN CANNABIS TAX REVENUE SINCE LEGALIZATION BEGUN!

Post a comment: