Cannacurio No. 99: Cultivation 2024 Q2 Leaderboard

Be the first to know when new content like this is available!

Subscribe to our newsletter to receive notifications of new posts, local news and industry insights.

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

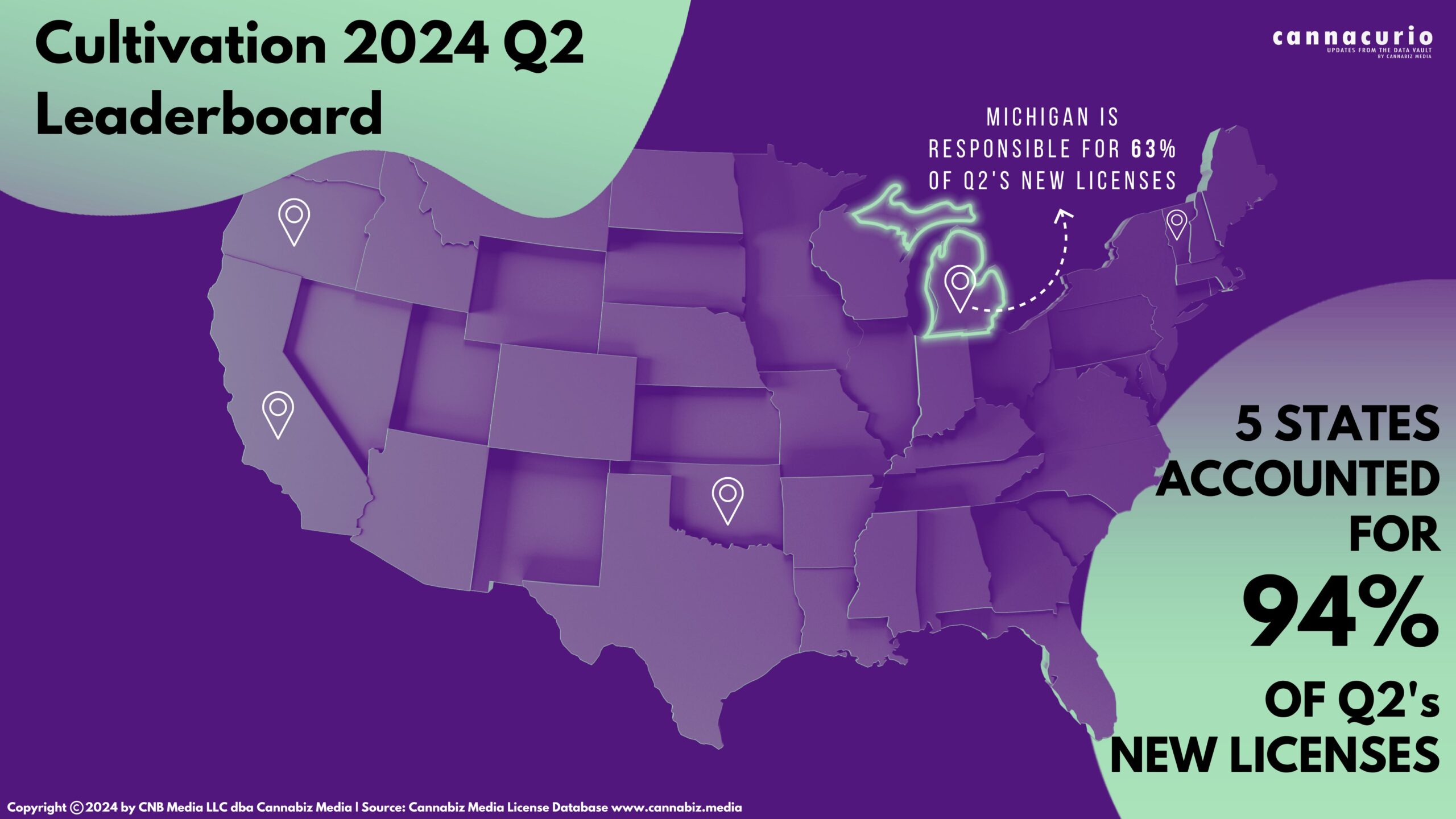

Following our recent overview of Q2 licensing, we now look at cultivation licenses for Q2 2024. These “census” snapshots from our Cannabiz Business Intelligence platform show where new licenses are being created.

- 14 states have issued new cultivation licenses – in the first quarter there were 18

- Regulators issued 1,090 cultivation licenses in the second quarter, more than in the first quarter (289).

- 94% of the new licenses were issued in 5 states, 63% of which were issued in Michigan.

- California leads the country with 5,167 active cultivation licenses

The following table shows the quarterly overview of new cultivation licenses added each month in the second quarter for the top ten states. The complete list of issuing states can be found on our Cannabis Market Intelligence Platform www.cannabiz.media.

The following table compares the number of new cultivation licenses over the last six quarters – it also includes a column showing Michigan's impact during that period:

Michigan

.jpeg)

Michigan issued 689 new licenses during the quarter – and 498 of them came from 10 farms! Here are the Michigan growers who received 498 cultivation licenses:

The case described above where 10 producers can cause such a “spike” in the market is rare, but by analyzing the data we were able to narrow the trend down to a handful of producers rather than a national trend.

California

California ended the quarter with 5,167 licenses, down slightly from the first quarter's 5,368 licenses (-3.7%). Facilities, which we define as companies with multiple licenses at one location, also saw a slight decrease from 3,153 to 3,087 (-2%).

The graph below shows the relationship between cultivation licenses and facilities in California over the past 12 months. The line graph shows the average licenses per facility, which have dropped from 1.96 to 1.7 during that time. Part of this decline may be due to the large indoor and outdoor cultivation facility licenses issued over the past 18 months. California currently has 59 active large cultivation facility licenses, 50 of which are outdoor cultivation facilities.

Oklahoma

The story in OK has been well documented on this blog. Between the license moratorium and increased enforcement, the trend has continued downward. By our count, the state has lost 2,911 cultivation licenses in the last 12 months.

The following ranking shows the top 10 states and the number of cultivation licenses we track. The nationwide total is down only 240 (1.3%) from the first quarter of 2024. The quarter ended with 17,659 active licenses. The full list of issuing states can be found on our Cannabis Market Intelligence Platform www.cannabiz.media.

The vast majority of cultivation licenses remain concentrated in a handful of states. The top 10 above account for 90% of cultivation licenses in the U.S. Unchanged from last quarter are all moratoriums in Vermont, Oklahoma, and Oregon. Oklahoma's tectonic pull remains strong as regulators reduce canopy size and crack down on illegal operations. If we exclude Oklahoma from our analysis, cultivation licenses would be up 2.2% nationwide since the end of the first quarter.

In the coming quarter, we will be watching Ohio, Delaware and Minnesota continue to develop their programs. We will also be tracking the likely licensing reduction as Michigan considers moving to a single medical and adult-use license rather than using separate licenses. California has implemented a similar program that has reduced complexity and licensing fees.

Cannabiz Media clients can stay up to date on these and other new licenses through our newsletters, alerts, and reporting modules. Subscribe to our newsletter to receive these weekly reports in your inbox. Or you can schedule a demo to get more information on how you can access the Cannabiz Media license database yourself to dive deeper into this data.

Ed Keating is the co-founder of Cannabiz Media and oversees the company's data research and government relations. He has spent his career working with and advising information companies on compliance. Ed has led product, marketing and sales while overseeing complex, multi-jurisdictional product lines in the securities, corporate, UCC, security, environmental and human resources sectors.

At Cannabiz Media, Ed enjoys the challenge of working with regulators around the world as he and his team gather corporate, financial and licensing information to track the people, products and companies in the cannabis economy.

Ed graduated from Hamilton College and received his MBA from the Kellogg School of Northwestern University.

Cannacurio is a Cannabiz Media column featuring insights from the most comprehensive market intelligence platform. Stay up to date with the latest updates and information through Cannacurio's posts and podcasts.

Post a comment: