Cannacurio No. 98: Q2 2024 License Summary

Be the first to know when new content like this is available!

Subscribe to our newsletter to receive notifications of new posts, local news and industry insights.

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

We're halfway through 2024 and it's time to review which states added or eliminated licenses in the second quarter.

In our Q1 report, we highlighted the states that were accelerating their rollouts or attempting to add an adult-use program to a medical program, but in Q2, we were inundated with programs that were in turmoil:

- New York: Governor calls introduction of program a “disaster” and director resigns

- Massachusetts: The Cannabis Control Commission could be taken over by a state bankruptcy trustee.

- Missouri: The manager of the Bureau of Investigations & Enforcement has abruptly left his post, joining a long list of resignations and departures within the department.

- Connecticut: The executive director of the Social Equity Council has resigned as the council undergoes an audit ordered by the governor.

The role of cannabis regulators presents numerous challenges for staff and industry representatives. Despite all this turmoil, states continued to issue licenses, but the total number of licenses and facilities continued to decline – thanks to Oklahoma.

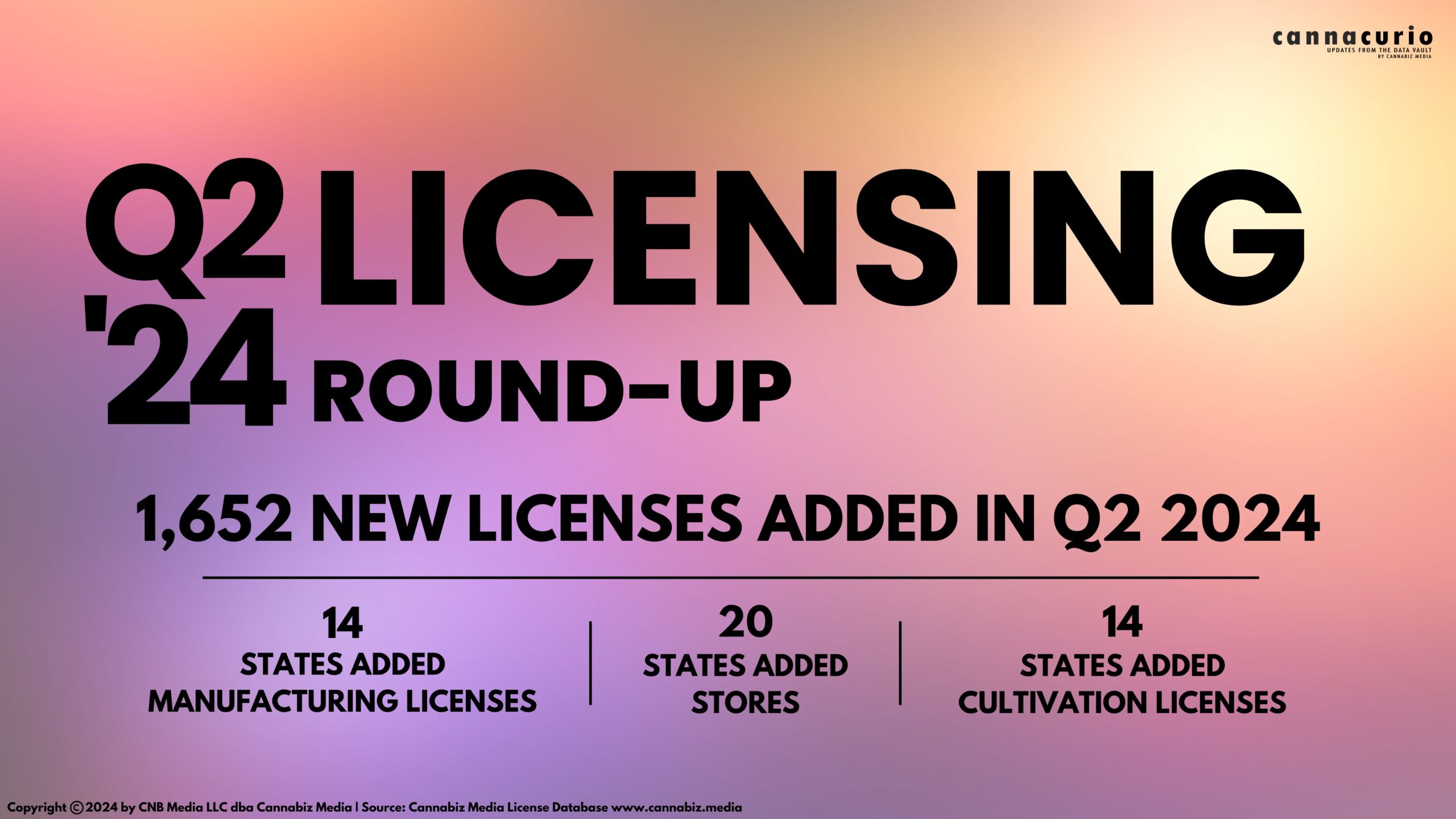

- In the second quarter of 2024, 1,652 new licenses for cultivation, production and storage were issued, significantly more than the 862 in the first quarter of 2024.

- 20 states have opened new stores (up from 24), 14 have opened new manufacturing licenses (up from 18), and 14 have opened new cultivation licenses (up from 18).

- The total number of active licenses fell by only 509 licenses to 37,945 since the end of the first quarter.

- If we exclude Oklahoma, licenses statewide have increased by 985, or 3.25%, over the past 12 months, while establishments have increased by 6.1%.

Not surprisingly, licenses and facilities evolve in roughly parallel ways, since in many states a license is synonymous with a facility.

.jpg)

The second quarter was nothing like the first quarter. April, May and June were all above the strongest months of the first quarter. 1,090 new cultivation licenses accounted for the quarter's growth, and 689 of those came from Michigan. Store and manufacturing licenses were issued at a pace close to the first quarter's levels.

Here is a summary of the three main license types in the value chain.

Shops

- In the second quarter, 316 new store licenses were issued, compared to 333 in the first quarter.

- 56% of these licenses were in 4 states: New Mexico, Michigan, New Jersey and Florida

- In the second quarter, Oklahoma lost 149 pharmacy licenses

Here are the five states that issued the most store licenses this quarter:

Cultivation

- Cultivation licenses boomed in the second quarter, but only in Michigan

- Michigan issued 689 new shares during the quarter – and 498 came from 10 farms!

- Oklahoma canceled 548 cultivation licenses in the second quarter

These 5 states issued the most cultivation licenses in the second quarter:

Here are the Michigan growers who secured 498 cultivation licenses:

Manufacturing

- In the second quarter, 202 manufacturing licenses were granted

- New Mexico issued 80 new licenses, with Michigan in second place with 29.

- Oklahoma lost 117 production licenses in the quarter

There has been a slight decline in licenses and facilities over the past 12 months. Looking at each state in detail, much of the decline is due to deflation in Oklahoma. The same is true of the “growth” in cultivation licenses in the second quarter. The vast majority of these were canopy expansions from ten farms in Michigan.

The lesson here is that each state is still its own “sovereign nation,” so we'll continue to look beyond the headlines to find out what's causing the nationwide increases and decreases. In our next posts, we'll dive into the details of key activities like storage, cultivation, and manufacturing.

Ed Keating is the co-founder of Cannabiz Media and oversees the company's data research and government relations. He has spent his career working with and advising information companies on compliance. Ed has led product, marketing and sales while overseeing complex, multi-jurisdictional product lines in the securities, corporate, UCC, security, environmental and human resources sectors.

At Cannabiz Media, Ed enjoys the challenge of working with regulators around the world as he and his team gather corporate, financial and licensing information to track the people, products and companies in the cannabis economy.

Ed graduated from Hamilton College and received his MBA from the Kellogg School of Northwestern University

Cannabiz Media clients can stay up to date on these and other new licenses through our newsletters, alerts and reporting modules. Subscribe to our newsletter to receive these weekly reports in your inbox. Or you can schedule a demo to get more information on how you can access the Cannabis Market Intelligence Platform yourself to dive deeper into this data.

Cannacurio is a Cannabiz Media column featuring insights from the most comprehensive cannabis market intelligence platform. Stay up to date with the latest updates and information through Cannacurio's posts and podcasts.

Post a comment: