Cannacurio #85: Third Quarter 2023 License Summary

Be the first to know when new content like this becomes available!

Subscribe to our newsletter to receive notifications of new posts, local news and industry insights.

Thank you very much! Your submission has been received!

Oops! An error occurred while submitting the form.

In a series of blog posts, we reviewed the new business, cultivation and manufacturing licenses issued through the third quarter. In this post, we will highlight the general trends and provide details on license growth and decline in key states.

Key findings

- There were 1,307 new licenses added in the third quarter – a slight decrease from 1,313 in the second quarter

- The 1,307 comprise 790 cultivation, 156 production and 361 store/dispensary licenses

- The total number of active licenses is virtually unchanged compared to the second quarter

- Change this year: Business +8.3%; Manufacturing +4%; Cultivation -11%

The number of active licenses has decreased by 3.13% since the beginning of the year. The table and graph below shows the impact of fewer cultivation licenses offset by the increase in store/dispensary licenses. Note that this table includes activities beyond storage, cultivation, and manufacturing:

Manufacturing

In the third quarter of 2023, we tracked sixteen states that issued manufacturing licenses. With the decline in Oklahoma, which has accounted for the majority of these licenses for several years, the picture is changing significantly.

- There were 156 new licenses issued in the third quarter, compared to 239 in the second quarter and 404 in the first quarter

- New Mexico led the third quarter with 51 new licenses, while New Jersey was second with 30

- Oklahoma gave up just 5 in the third quarter compared to 235 in the first quarter

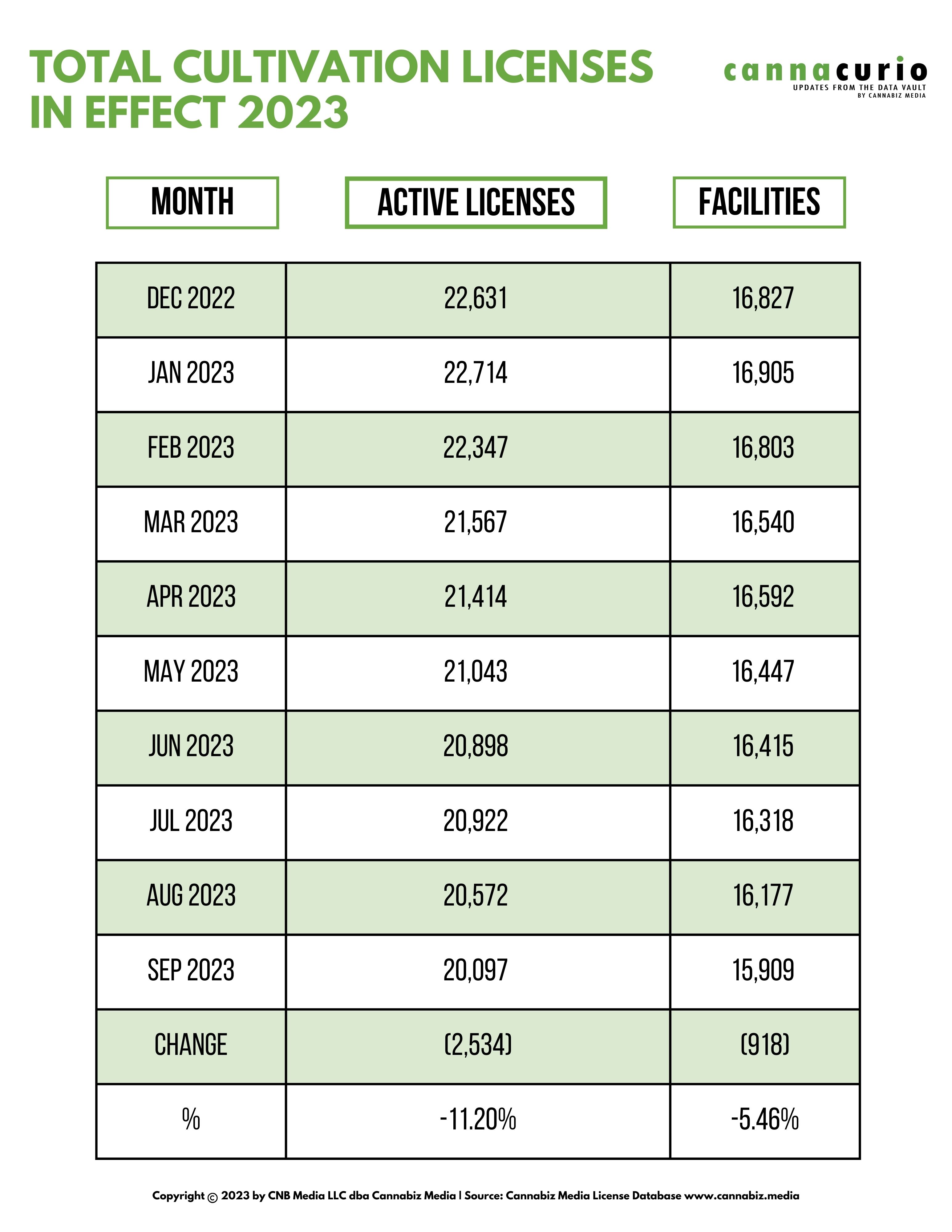

Cultivation

- The total number of cultivation licenses decreased by over 3,000 (-13%) compared to the previous year

- Regulators issued 790 new cultivation licenses in the third quarter, compared to 635 in the second quarter (+24%).

- 91% of new licenses in the third quarter came from five states: Michigan (57%), California (16.7%), Vermont (9.5%), New Jersey (6%) and Mississippi (2%).

The following graphic shows the total active cultivation licenses. The total number of licenses nationwide has decreased by 13%, despite all the new licenses listed in the table above. Note the Y

Axis scale.

.jpg)

Shops/pharmacies

Here is our summary of the states that issued pharmacy/retail licenses in Q3 2023. So far this year, we have added 716 stores in the first quarter of 2023; 471 in the second quarter and only 361 in the third quarter. Five states accounted for 69% of these Q3 licenses: New Jersey, Michigan, California, New Mexico and Maine.

Highlights

- New Jersey, Michigan, California, New Mexico and Maine account for 69% of Q3 licenses.

- Oklahoma issued just three licenses, down from 11 in the second quarter and 332 in the first quarter.

- The two northeastern states of New Jersey and Maine combined accounted for 38% of all store licenses in the third quarter.

Diploma

Cannabiz Media has been tracking licenses for almost a decade and 2023 has been just as eventful as previous years, with major volatility in the mix. This year we saw: Business +8.3%; Manufacturing +4%; Cultivation -11%. It’s important to look beneath the headlines to see what’s driving these changes.

moratorium – Currently, as far as we know, there are three running in Montana, Oregon and Oklahoma. New ones have been proposed in Vermont to protect local producers and in Illinois to help retailers in the state. Oklahoma also extended its blanket moratorium through 2026.

Rule changes – The number of California farmers opting for large licenses increased from 2 in the first quarter to 40 in the third quarter. This allows farmers to consolidate their acreage under one license rather than having to manage many small acreages. This will certainly reduce the number of licenses, but not the number of facilities we cover.

Raids – Oklahoma has rigorously enforced a host of new rules and regulators are shutting down both legal and illegal grows. Your license number has continued to decline. Similar rumors abound in Maine, where Maine Wire’s extensive local reporting identified hundreds of illegal grows founded with money from China.

We’re well into the fourth quarter and some companies reported slightly better earnings than expected. Combined with ongoing rumors of debt restructuring and safer banking, it’s likely to be an interesting and volatile quarter.

Ed Keating is co-founder of Cannabiz Media and oversees the company’s data research and government relations. Throughout his career, he has worked with and advised information companies in the compliance area. Ed has led product, marketing and sales while overseeing complex, multi-country product lines in securities, corporate, UCC, security, environmental and human resources.

At Cannabiz Media, Ed enjoys the challenge of working with regulators around the world as he and his team collect corporate, financial and licensing information to track the people, products and companies in the cannabis economy.

Ed graduated from Hamilton College and received his MBA from the Kellogg School of Northwestern University

Cannabiz Media customers can stay up to date on these and other new licenses through our newsletter, alerts and reporting modules. Subscribe to our newsletter to receive these weekly reports straight to your inbox. Or you can schedule a demo to get more information about how you can access the Cannabis Market Intelligence Platform yourself and dive deeper into this data.

Cannacurio is a weekly column from Cannabiz Media featuring insights from the most comprehensive cannabis market intelligence platform. Check out Cannacurio posts and podcasts for the latest updates and information.

Post a comment: