Cannacurio #57: Are public MSOs building or buying their cannabis shops?

Be the first to know when new content like this is available!

Subscribe to our newsletter to receive notifications of new posts, local news and industry insights.

Thanks! Your submission has been received!

Oops! Something went wrong while submitting the form.

Cannabiz Media has been pursuing cannabis and hemp licenses worldwide since 2015. In those seven years, we’ve collected a lot of data about licenses, companies, and transactions that result in license ownership changes.

After compiling 500 transactions in our Cannabiz Intelligence™ platform, we wanted to take a closer look at how major publicly traded MSOs increased their branch presence. Our goal was to determine which stores were ‘built’ and which were ‘bought’.

Important Findings

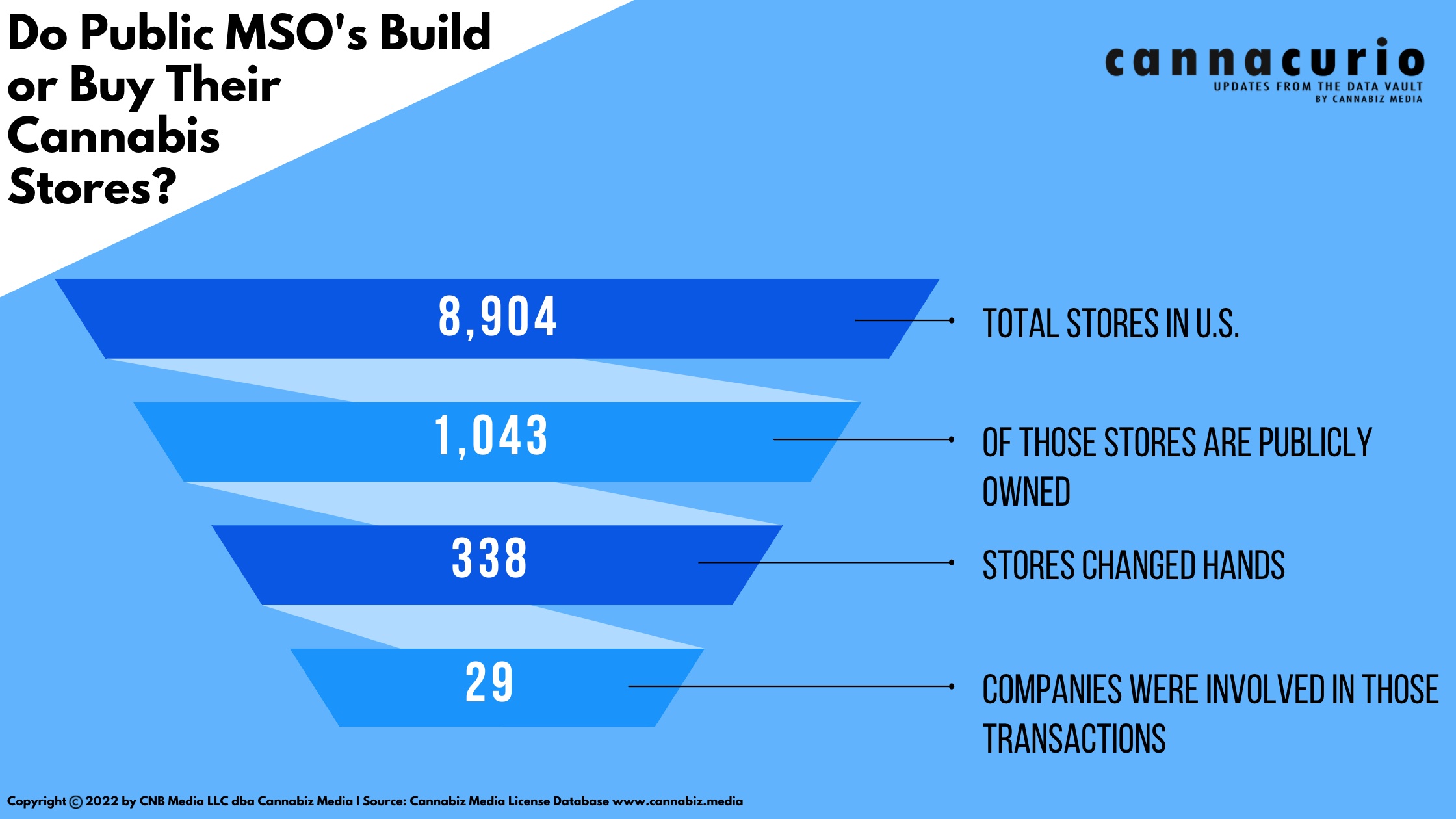

- Almost 12% of US cannabis stores are owned by a public company.

- 338 of these stores have changed hands and 29 public companies have been involved in these transactions.

- Almost 60% of store purchases were made in five states (Florida, Colorado, Pennsylvania, California and Arizona).

- The number of branch changes has increased from year to year. In 2021 we found 185 stores that were purchased, up from 53 in 2020.

background

According to the Cannabiz Media License Database, there are currently 8,909 stores/dispensaries in the US. Of these licenses, 1,048 (11.8%) are owned by public companies and we found 338 stores that changed hands. A total of 29 public companies were involved in these transactions.

The chart below shows the number of stores that have changed hands. We only considered completed deals.

leaderboard

In an attempt to assess the impact on footprint, we compared the number of stores purchased versus the number of stores built or leased. The ranking below shows public MSOs that bought at least 10 stores.

Based on our analysis, Trulieve has bought the most stores (54), and that accounts for 32% of its footprint. AYR Wellness acquired 42, representing 62% of its stores. Curaleaf, a company with a very large presence, has only acquired 15 stores. $1.2 billion was spent by these companies to acquire these licenses.

- In the table above, Schwazze bought 77% of its licenses with AYR Wellness 62%. Cresco ranks third with 56%, but that will change once the Columbia Care acquisition closes.

- Verano spent the most at $202 million, Cresco at $178 million and Trulieve at $176 million.

- Verano paid the most per deal at $9.64 million, while Schwazze paid the least at $1.79 million.

geography

More business was acquired in restricted license states than in unlimited license states. Restricted license environments are more predictable thanks to the oligopolistic protections provided by the regulations. Early entrants are well positioned when the inevitable market opens up to adult use, and they have benefits including customers, marketing, branding, real estate, and established relationships with regulators.

The M&A hotspots table shows the states in which public MSOs have invested.

Conclusion

We don’t see an end to this trend anytime soon. Cresco and Columbia Care’s recent blockbuster deal will cause license cap issues in some states, which will require a divestment. In future posts, we plan to address the license cap issue and address which states have obtained their licenses MSO – like Connecticut. We also welcome your questions, so contact ekeating @cannabiz.media directly.

methodology

Analysis like this is as much art as science, so here’s some of the logic we used:

- Only active licenses are counted. Pending and requested licenses are not included, nor are future licenses that a company is authorized to operate. This approach makes some of the Pennsylvania licenses seem very expensive, as operators bought those licenses knowing they could run multiple businesses.

- In large transactions where a large number of assets were acquired, we have withdrawn the value of cultivation/production assets based on comparable transactions where available.

- We try to be comprehensive, but we may not have captured every deal, and in some cases the MSO may have considered a small acquisition to be immaterial.

- In addition to the Cannabiz Intelligence platform, the team derived transactional data from SEC and SEDAR filings, as well as company press releases, investor decks and investor relations staff.

Ed Keating is co-founder of Cannabiz Media and oversees the company’s data research and government relations. He has spent his career working with and advising information companies on compliance issues. Ed has led product, marketing and sales while overseeing complex, multi-jurisdictional product lines in the securities, corporate, UCC, security, environmental and human resources markets.

Shea Sanford is product manager for the product Cannabiz Intelligence of Cannabiz Media. He is responsible for tracking down corporate transactions and keeping track of MSOs, SSOs, REITs, SPACs and any other acronyms we can find.

Cannabiz Media customers can stay up to date on these and other new licenses through our newsletter, notification and reporting modules. Subscribe to our newsletter to receive these weekly reports in your inbox. Or you can schedule a demo to learn more about how to access the Cannabiz media license database yourself to dig deeper into this data.

Cannacurio is a weekly column from Cannabiz Media featuring insights from the most comprehensive licensing data platform. Check out Cannacurio’s posts and podcasts for the latest updates and information.

Post a comment: