Cannacurio #55: Manufacturing Licenses | cannabis media

Be the first to know when new content like this is available!

Subscribe to our newsletter to receive notifications of new posts, local news and industry insights.

Thanks! Your submission has been received!

Oops! Something went wrong while submitting the form.

Cannabis manufacturing licenses are granted more slowly than cultivation or retail licenses. However, they are important assets for companies because the products are often strong brands. These brands, unlike licensed assets, can cross state lines and will no doubt help established companies thrive and gain market share.

background

We categorize a license as a producer if it fits the following description: The license is for processing (manufacturing) marijuana-infused products such as edibles or concentrates, but does not include cultivation or retail sale to customers (flower in, product out) .

States rarely agree when it comes to these licenses. In some jurisdictions, cultivation and manufacturing activities can be combined under a single license, such as in Connecticut and New Mexico. In other jurisdictions such as Florida and New York, the licensee must conduct all cultivation, manufacture, and sale under his license. Georgia and Alabama are also following this oligopolistic path.

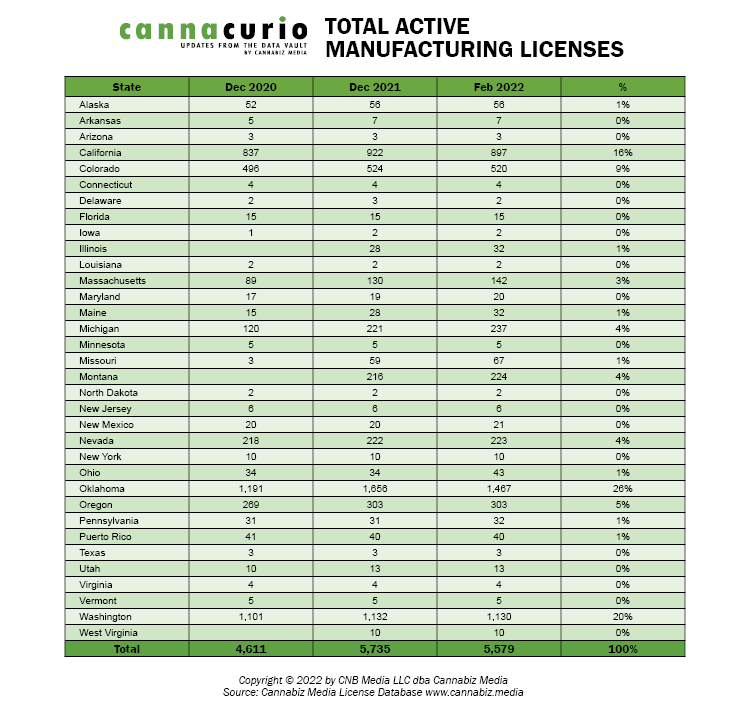

We ended 2021 with 5,735 manufacturing licenses, up from 4,611 the previous year. So far this year, states have added 241 more licenses in the first two months of the year.

leaderboard

Here is the ranking comparing year-end 2020, year-end 2021 and February 2022. As usual, the ranking is highly concentrated, with five states accounting for 77% of the licenses.

Conclusion

Some consider manufacturing to be one of the sweet spots in the cannabis value chain. You are not subject to the challenges of farming or commodification, nor do you have to deal with the thin margins of retail.

Manufacturers have the best opportunities to build a brand, and that makes them an attractive part of the value chain for transplanted talent from spirits, packaged goods and pharmaceuticals because they appear familiar. As MSOs continue to merge, it will be interesting to follow how they manage these assets – subject to any government caps. There are certainly concentrations of these licenses in old and big market states.

About the author

Ed Keating is co-founder of Cannabiz Media and oversees the company’s data research and government relations efforts. He has spent his career working with and advising information companies on compliance issues. Ed has led product, marketing and sales while overseeing complex, multi-jurisdictional product lines in the securities, corporate, UCC, security, environmental and human resources markets.

At Cannabiz Media, Ed enjoys the challenge of working with regulatory bodies around the world as he and his team gather corporate, financial and licensing information to track the people, products and companies in the cannabis economy.

Ed graduated from Hamilton College and received his MBA from the Kellogg School at Northwestern University.

Cannabiz Media customers can stay up to date on these and other new licenses through our newsletter, notification and reporting modules. Subscribe to our newsletter to receive these weekly reports in your inbox. Or you can schedule a demo to learn more about how to access the Cannabiz media license database yourself to dig deeper into this data.

Cannacurio is a weekly column from Cannabiz Media featuring insights from the most comprehensive licensing data platform. Check out Cannacurio’s posts and podcasts for the latest updates and information.

Post a comment: