Cannacurio #110: Manufacturing 2024 Years of Loy

Be the first to know when new content is available!

Subscribe to our newsletter to receive notifications about new contributions, local news and industry knowledge.

Thank you very much! Your submission was received!

Oops! Something went wrong when submitting the form.

background

In the last of our annual license reviews, we turn to the production, which is the least volatile of the three activities that we cover. At Cannabiz Media, we classify a manufacturer as a license holder who processes products infused by cannabis such as food or concentrations, but does not cultivate or sell to customers (flowers, product equipment). Cannabis Manufacturing licenses are spent more slowly than growing or retail licenses.

However, they serve as important assets for companies because the products are often powerful brands. In contrast to license, these brands can exceed state limits and help well -established companies and build market share. They are also useful for the license holder because these facilities can be used for the production of the white label and therefore expand the value of the financial value.

Key results

- 945 new production licenses were issued in 2024 – compared to 744 in 2023 (+27%)

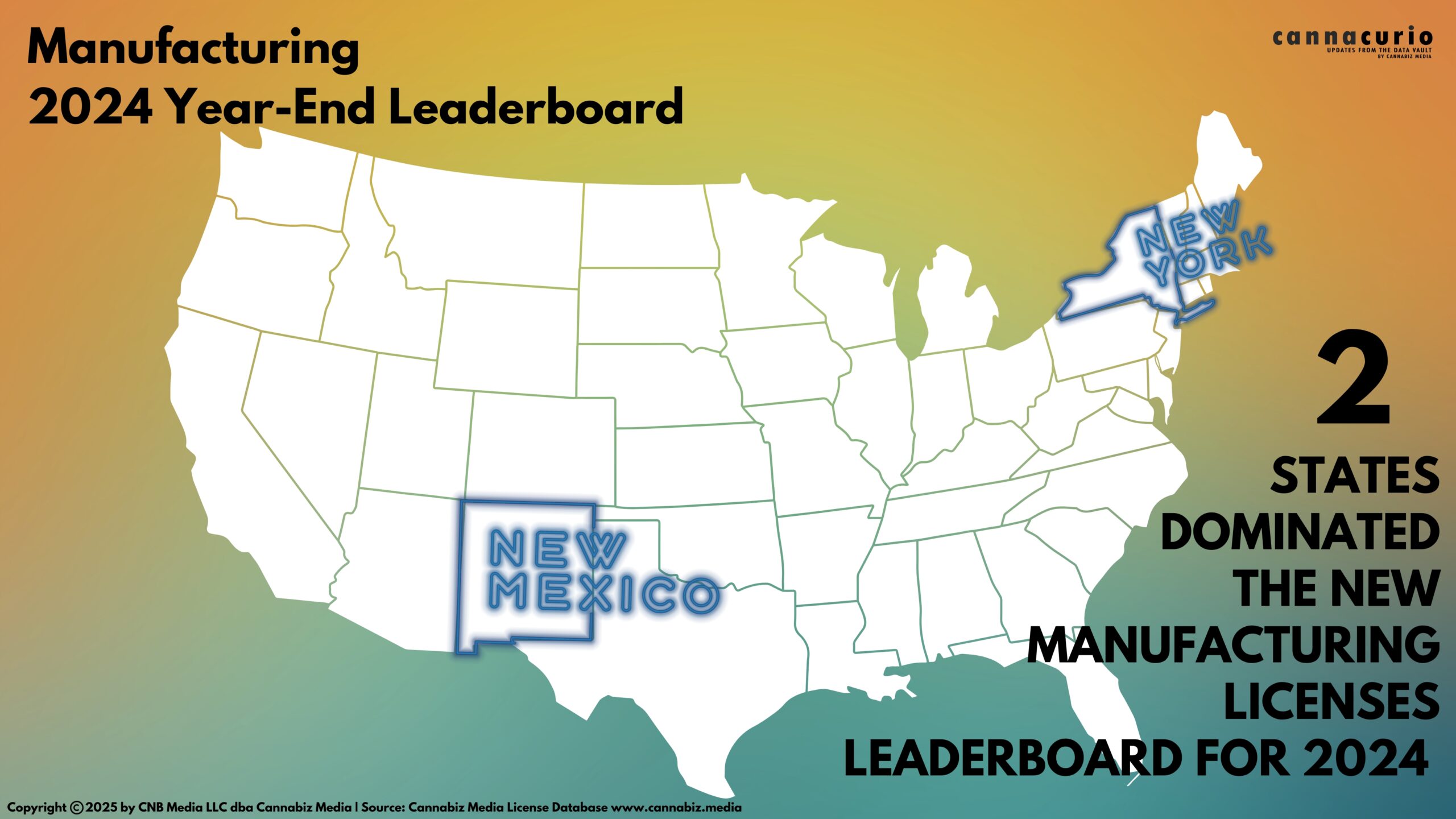

- New York led and granted 264 licenses (28%) with 166 (17.6%).

- 28 countries explained licenses in 2024

- The total number of the manufacturers was stable at 5,940, slightly according to 6.101 (-2.6%).

As we see in other activities, most new licenses were given by a handful of states. 5 states spent 66% of all new licenses. New York, New Mexico and Michigan were sitting on the ranking. The following graphic shows the largest issuers of new production licenses in 2024.

Ranking

Here is the ranking list that shows the entire production licenses for the top 10 states for the year 2024.

Diploma

The processing industry in the cannabis industry remains a cornerstone of stability in the middle of the wider market volatility. With the granting of 945 new licenses in 2024 – a remarkable increase of 27% compared to the previous year – the growth of the sector continues, largely by key states such as New York and New Mexico. These licenses not only pave the way for brand development and the opportunities of white brand, but also serve as valuable assets that overcome the state limits. While the concentration of licenses in a handful of states emphasize regional dynamics, the overall stability of the number of manufacturers underlines the resistance and the strategic importance of the sector in the developing cannabis economy.

author

Ed Keating is a co -founder of cannabiz media and monitors data research and the efforts of the company's government relationships. He spent his career to work and share information companies in the compliance area. ED has managed product, marketing and sales and at the same time monitored complex product lines for the majority in the securities, company, UCC, security, environmental and personnel markets.

At Cannabiz Media, ED enjoys the challenge of working with supervisory authorities around the world, while he and his team collect companies, financial and licensed information in order to pursue people, products and companies in cannabis economy.

Ed completed the Hamilton College and received his MBA from the Kellogg School at Northwestern University.

Cannabiz media customers can stay up to date via our newsletter, warnings and reports about these and other new licenses. Subscribe to our newsletter to receive these weekly reports that are delivered to your inbox. Or you can plan a demo to get more information about access to the Cannabiz Media Market Intelligence platform yourself in order to continue to immerse yourself in this data.

Cannacurio is a weekly column of cannabiz media with insights from the most comprehensive license data platform. Record Cannacurio contributions and podcasts for the latest updates and Intel.

Post a comment: