Cannacurio #108: pharmacy and retailer 2023 year ranking

Be the first to know when new content is available!

Subscribe to our newsletter to receive notifications about new contributions, local news and industry knowledge.

Thank you very much! Your submission was received!

Oops! Something went wrong when submitting the form.

The number of shops or doors is still an important cannabis metric. The following diagram shows the growth of both business and licenses in the past twelve months. The spread of smoke, vape and hemp dealers continues to have an impact, since there are many more distribution points than ever. This is in addition to the legacy market.

- New York made up 533 (28%) of the newly issued licenses from 19 in 2023

- Michigan was second with New Jersey with 174 out of 224 in the previous year after 243 last year.

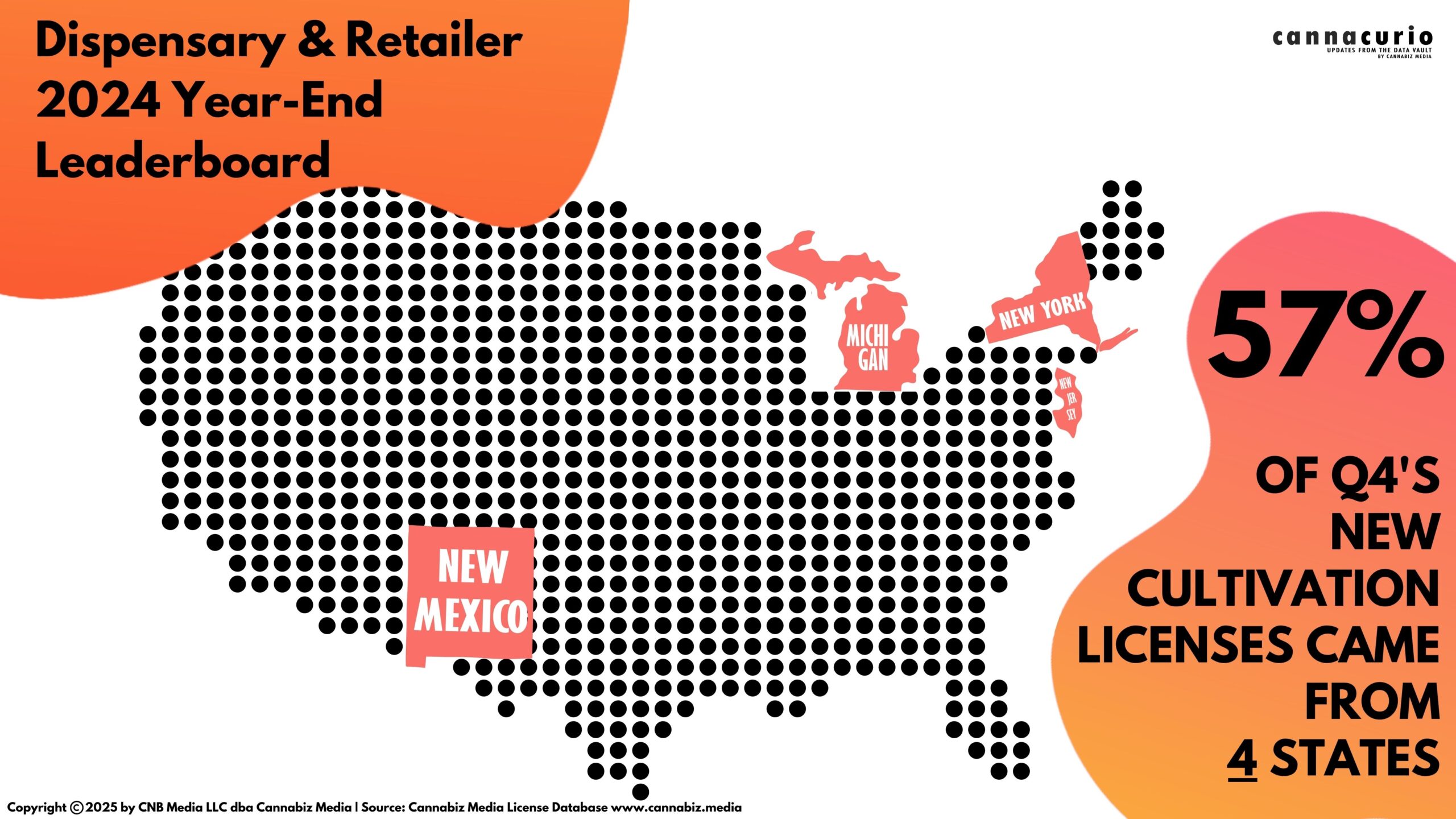

- The 4 top countries spent 57% of the newly issued licenses – compared to 60% in the previous year.

- At the end of 2024 there were 12,349 shops that were 13,016 licenses in the management.

Here is a graphic view of the new shops that have been added until the month. The nation scored an average of 157 new shops per month with little variability from month to month. The low was 106 in November and with a high of 244 in August.

The ratio of licenses to facilities shrinks slowly. At the beginning of 2023 there were about 108 licenses per 100 facilities. By the end of 2024, this number had dehydrated to 105 licenses per 100 facilities. We believe that this is largely due to administrative changes in states such as Nevada and New Mexico, in which the operators do not require separate medical and adult usage licenses.

One final view is to understand the effects of Oklahoma. Thanks to the enforcement and a license moratorium, the number of business in the state shrank from 2,297 to 1,781 for a decrease of 22%. Removing this okahoma effect from the numbers and the number of shops at the national level rose by 14%and not only by 7%.

The business grew in 2024 when new states came online and how others like New York increased their license output. We estimate that the number of transactions has increased nationally by 7% or 14% when Oklahoma is excluded. The industry will continue to concentrate on the and expanded programs such as Delaware, Kentucky and Minnesota in 2025.

The increase in drinks also has an impact on these products, which are often derived, available via postal instructions, Grubhub or in traditional spirits. The hemp and spirits industry has teamed up to expand this category. The focus will be particularly focused on Minnesota, which means that the drinks can be sold together with alcoholic.

Cannabiz media customers can stay up to date via our newsletter, warnings and reports about these and other new licenses. Subscribe to our newsletter to receive these weekly reports that are delivered to your inbox. Or you can plan a demo to get more information about access to the Cannabiz media license database yourself in order to continue to immerse yourself in this data.

author

Ed Keating is a co -founder of Cannabiz Media and monitors data research and the efforts of the company's government relationships. He spent his career to work and share information companies in the compliance area. ED has managed product, marketing and sales and at the same time monitored complex product lines for the majority in the securities, company, UCC, security, environmental and personnel markets.

ΦCannacurio is a column of cannabiz media with insights from the most comprehensive license data platform. Record Cannacurio contributions and podcasts for the latest updates and Intel.

Post a comment: