Cannabis Prices: Are We In A Race To The Bottom?

Canada’s first wave of private cannabis stores was dominated by retail space designed to mimic the Apple Store, with iPads on crisp white countertops to scroll through product selections.

“You would have people who had never used cannabis before giving up Pinot Grigio for Pink Kush,” said Darren Karasiuk, Nova Cannabis CEO.

There were shops for the ambitious consumer – warm wood accents, greens, and scented candles, much like yoga studios and spas.

But this year a new approach to cannabis retail emerged: the cannabis discount store. Walmart’s emerged from weed, peer-to-peer competitors and drastic cost reductions to attract consumers.

How deep can they go?

The Edmonton-based company owns and operates all 71 Value Buds stores in Alberta and Ontario designed for knowledgeable, high-volume cannabis buyers who know what they’re looking for.

Based on the resources and strategies of major investor Alcanna, a private liquor retailer in Alberta, Value Buds stores sell ounces (28g) of dried flowers at prices as low as $ 56.57 before tax.

“If we have a lot of players who do that, we’ll create a kind of race to the bottom. And that’s a really, really tough place to be in. “

Krista Raymer, a cannabis retail strategist and co-founder of the Vetrina Group

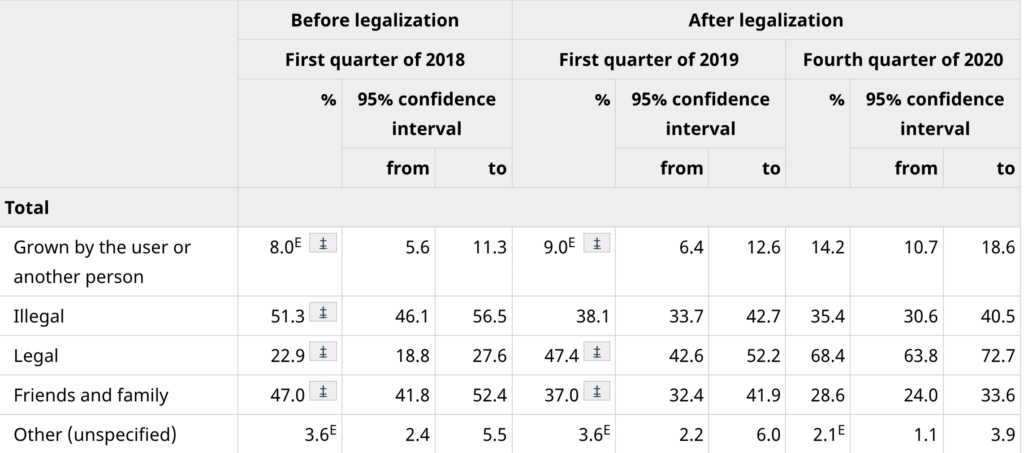

“There’s a place in the market for the premium consumer, but it’s not nearly as big as the value consumer,” he says, noting that Statistics Canada says 35.4% of cannabis users said they still don’t regulated source to buy in 2020.

“We are building our strategy on the basis of the current customer and there is still a lot of room to grow on the unregulated side.”

According to a report by Deloitte released in early November, pricing has emerged as one of the most important factors for cannabis buyers. Around 34% of those surveyed stated that price was the “leading factor influencing product selection” and cited data from the latest BDSA Consumer Insights Survey.

“In 2021, average prices in most categories continued to decline due to increased competition and oversupply of inventory relative to sales. [Which] resulted in a much wider range of price ranges, both low and high, ”explains Sid Hathiramani, Partner at Risk Advisory, Deloitte Canada.

It’s hard to know when cannabis product prices will coincide with the level-out. Hathiramani explains to Leafly that there has been rapid price pressure in states like Colorado and Oregon due to the oversupply. In these cases, prices increased gradually as competition normalized and consumers began to see the value of higher quality products.

“We expect a similar trend in Canada, albeit over a longer period of time, as the licensing and distribution framework allows new suppliers and products to enter the market more gradually,” says Hathiramani.

The hidden costs of low prices

Price is also one of the few differentiators that retailers and brands have to play in the tightly regulated market, where stores carry largely the same products that are sourced through provincial wholesalers.

“Where retailers can compete is limited and price becomes a really attractive strategy,” said Krista Raymer, a cannabis retail strategist and co-founder of the Vetrina Group, on a phone call.

“If we have a lot of players who do that, we’ll create a kind of race to the bottom. And that’s really, really hard. If we don’t get any income from other business areas because we have such tight margins in the beginning. “

One way to keep prices down is through the white label strategy, she said – repackaging and selling cannabis from unknown sources at a discounted price. However, given the already low profit margins, there is pressure to offset these sales in other business areas, either with lower operating costs or higher prices in other product categories in the store, such as premium or craft products.

According to Jennawae McLean, founder and CEO of Kingston, Ontario’s independent cannabis business Calyx + Trichomes, and managing director of NORML Canada, prices were way too high for adults when legalization began.

She was happy to see prices go down – up to a point.

“Our prices are close to value brands, but we are still not necessarily as low as they are because we still have to pay for a living wage and still have to pay for benefits,” she said on a phone call.

“You know, a lot of the reasons we’re number one in the east [Ontario] Region is that we have the best team in the eastern region. And the reason why we have the best team is that we try to add value to your life as an employer. ”

She suspects that the majority of the store’s customers don’t care whether the staff is paid well or not, but that the customer experience is vastly improved due to the higher operating costs associated with employee training and retention.

McLean also said that it’s not just prices that discount stores are competing for. Companies with large wallets are better able to pay for prime commercial real estate locations that are more visible and attractive.

Cannabis reward clubs are on the rise

High Tide is the newest player to enter the race, this time through a discount club concept. In October, the company announced that Cabana Club memberships would be available in all 101 retail stores in Manitoba, Saskatchewan, Alberta, and Ontario.

CEO Raj Grover said the Cabana Club currently has 270,000 members who are benefiting from lower prices on in-house brands and accessories. There is currently no registration fee as there is for parallel companies like Costco, but that may change in the future.

The company also hopes to break into the unregulated market, which, according to Grover, is valued at around $ 3 billion in Canada. The Deloitte report also highlighted the remaining growth opportunities in the illegal market, saying: “… 70% of those surveyed who shop in the illegal market said better or lower prices were a major reason for moving to that market. “

“I think the illegal cannabis market is getting thinner and thinner,” Grover said on a phone call. “The measures that we have now taken with our innovative discount club concept, the first of its kind in North America, will definitely make a significant contribution here in Canada to bringing down the illegal market in my opinion.”

Grover said he hopes to roll out the model in the US when Canadian companies can enter the market. “If the US opens up,” he said, “I can’t wait to introduce this concept in the United States.”

By submitting this form, you subscribe to Leafly news and promotional emails and agree to Leafly’s Terms of Use and Privacy Policy. You can unsubscribe from Leafly email messages at any time.

Post a comment: