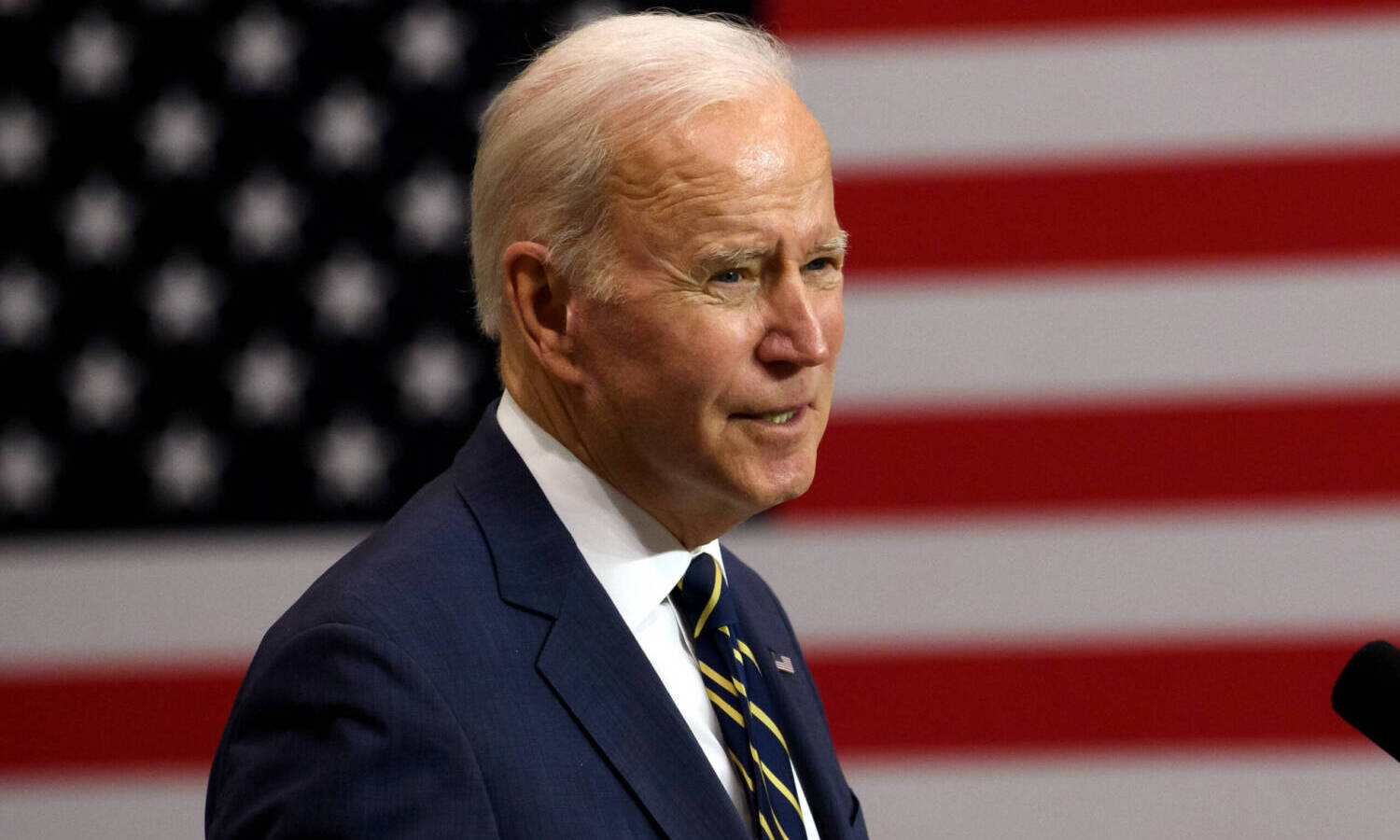

Biden is unlikely to respond to marijuana before the midterms

Through

Democrats are becoming increasingly vocal about cannabis policy reforms as midterm approaches. They urge President Biden to act on this matter. Pennsylvania Lt. gov. John Fetterman recently called on the President to remove marijuana from a Schedule I drug and work to decriminalize it, prompting the two politicians’ paths to cross in Pittsburgh and potential changes to the status of cannabis under the Controlled Substances Act discussed.

However, it appears that Biden will remain silent on the issue, at least ahead of the midterm elections, judging by the recent statement from the White House, Karine Jean-Pierre, Marijuana Moment reported.

“I have nothing further to share in the coming weeks,” Jean-Pierre said Friday during a press briefing aboard Air Force One. She added that the President’s stance on cannabis was unchanged. He wants to reschedule marijuana, decriminalize the plant at the federal level and erase previous records while leaving recreational legalization to the states, the spokesman continued.

“The President believes there are too many people serving unreasonably long sentences for nonviolent drug offenses — a disproportionate number of whom are black and brown,” Jean-Pierre added.

SAFE banking law in the spotlight again

Meanwhile, the SAFE Banking Act, a measure designed to protect banks and credit unions that work with cannabis companies from legal sanctions, was discussed at a recent Senate hearing, the news agency reported.

Lawmakers reviewed the law, first introduced by Colorado Rep. Ed Perlmutter, during a session of the Senate Banking Committee focused on insurance issues.

Senator Bob Menendez (D-NJ) emphasized the importance of banking reform, which includes insurance-related provisions stemming from his bill entitled Clarifying Law Around Insurance of Marijuana (CLAIM). To illustrate potential underwriting hurdles cannabis utilities might face when working with marijuana companies, the senator gave an example of a lightbulb manufacturer and a hypothetical product malfunction.

Photo by Baris-Ozer/Getty Images

RELATED: NORML Op-ed: Prohibitionists fear democracy more than marijuana

“Consider a scenario where a New Jersey lightbulb manufacturer sells a product to a state-legal cannabis company and there is a lightbulb-related fire, causing the company to incur losses,” Menendez said. “Under current law, in the scenario I just described, could the lightbulb manufacturer’s insurance company face federal fees if they paid the claim?”

Kathleen Birrane, a representative for the National Association of Insurance Commissioners (NAIC), acknowledged that the SAFE Banking Act would provide significant protections for ancillary businesses.

“It’s really critical that companies can buy insurance, that they can pay for that insurance, and that when claims arise, insurance companies can use the banking system to pay for those claims,” she said. “The SAFE Banking Act would make that possible.”

RELATED: Biden weighs cannabis during meeting with PA Senate nominee Fetterman

Meanwhile, a recent poll by the Independent Community Bankers of America found that two-thirds of voters (65%) support cannabis banking reform. The same poll showed bipartisan public support for Congress passing the bill.

In June, the Senate rejected bipartisan marijuana-banking legislation in the final version of the United States Innovation and Competition Act (aka The America COMPETES Act) for the sixth time.

This article originally appeared on Benzinga and has been republished with permission.

Post a comment: