Artisan farmers are pushing for excise tax reform in Canada

The founder of a cannabis company in BC is trying to raise awareness of an issue that many in the industry say is threatening to put small cannabis companies out of business.

According to Dan Sutton, CEO of Tantalus Labs, a cannabis grower and processor based about an hour outside of Vancouver, the current federal excise tax on cannabis doesn’t reflect the realities of the market.

The main issue? Excise tax is set at a flat rate of $ 1 per gram rather than a percentage of sales. Instead, Sutton says the tax should be based on the scale, much like they do in the beer industry.

According to Sutton, Canadian craft cannabis is taxed to death. That is why he heads the Stand for Craft campaign, where people learn more about the topic, literature and opportunities to contact politicians.

If you believe small businesses deserve their place in the future of Canadian cannabis, we need your vote today.

https://t.co/qpmTgSJAth reinforces this message to over 100 government actors with the power to make change.

Add your voice. Stand with us. Stand for craft.

– Dan Sutton (@ DSutton1986) September 29, 2021

The excise duty should not be a flat rate

The excise tax was introduced when the federal government legalized cannabis. Cannabis companies that sell products to consumers in the provincial market or in the medical field are required to pay a flat rate tax.

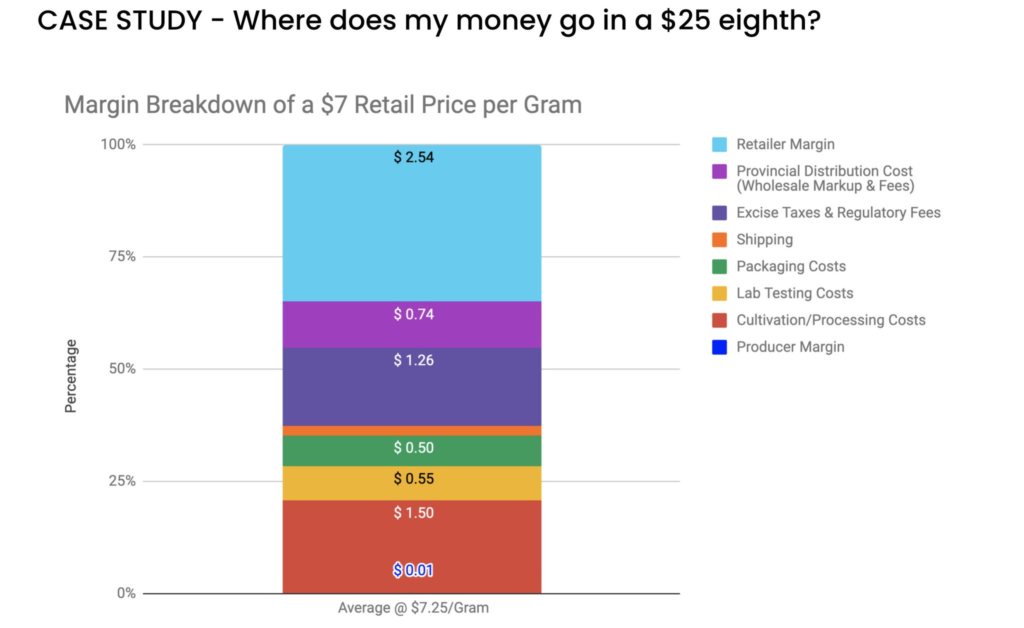

If you overlook a few small nuances, it breaks down to roughly $ 1 per gram of cannabis sold. Seventy-five percent of these taxes go to the provinces, while twenty-five percent goes to the federal government.

This rate was set in part because the federal government put the average cost of cannabis at around $ 10 per gram at the time of legalization.

“Since the beginning of legalization, the excise tax system as it exists today has resulted in micro-businesses, craft businesses and small and medium-sized enterprises being taxed on more than 20-30% of their turnover.”

The problem with this, Sutton says, is that that flat rate means roughly a quarter or more of a company’s sales must be paid on the wholesale price of cannabis. “For every dollar you make, you have to pay thirty points on the package before you even get a penny.”

Stand for Craft requires a percentage sales tax

Instead of a flat rate, Sutton would prefer to switch to a number based on the percentage of sales. Paid according to the consumer price and not the wholesale price.

“If we want an industry that includes small businesses, if we want an industry that includes companies that are not subsidized by shareholders investing millions, we need to revise those excise taxes now,” says Sutton. “We have to tax wholesale prices: a variable percentage.”

If a producer’s profit margin is only $ 2-3 per gram, that $ 1 excise tax can swallow up 20-30% of the company’s profits. Sutton predicts that if prices continue to fall, prices could account for 50% or more of sales.

A revenue-based tiering would still allow governments to generate revenue, but would not push small cannabis companies into bankruptcy.

“A change is needed so these companies can make enough money to sustain themselves. Not to get rich quick, not to blow up uncontrollably, but simply to stop the lights and grow your business organically. “

Coast to coast artisan growers are joining the cause

Sutton and Tantalus aren’t the only ones feeling the pain. Kieley Beaudry, the owner of Parkland Flower, an Alberta micro-cultivator and processor that sells seeds, flowers and pre-rolls to multiple provinces, is also feeling the pressure.

Beaudry, who is also the chair of the Alberta Cannabis Micro License Association (ACMLA), says she and the ACMLA are on board to bring more attention to the issue.

In case you’re wondering what Violator Kush looks like when it’s done.

Hack next week! #GrowWithUs pic.twitter.com/VXsdAlpBGE

– ParklandFlower (@ParklandFlower) November 25, 2020

“At ACMLA, we take responsibility for Dan,” says Beaudry. “A lot of it brings our voices together as a group. I think that will be the key. “

She says her focus is primarily on politicians at all levels and helping them understand that this is an issue that affects small businesses in their rides.

“It’s about the local politicians – we have to get them over with. With local elections (in Alberta) going on, this is a good time to speak to candidates and ask for their opinion. “

Times have changed, and so must excise duty

“I don’t think the industry will refuse to pay an excise duty as long as it is reasonable and can adapt quickly to a constantly fluctuating market,” said Tom Ulanowski, VP of Quality Assurance and Regulatory Affairs at Nextleaf Labs Ltd.

Ulanowski explains that the excise tax is currently based on price assumptions from before legalization. But three years after legalization, the average price for flowers and extracts has fallen below expectations. The excise duty is out of date and needs to be revised.

“At $ 8-9 a gram wholesale, it made financial sense,” says Sutton. “But that’s not where [the market] has landed. It’s much lower than that, so we need guidelines that respond to market conditions. “

The hope for the “Stand with Craft” movement is to bring the issue to the fore – especially as the federal government begins a mandatory three-year review of legalization in October – to try to change the policy in a. better design positive ways.

“It’s not that I don’t want to pay taxes,” says Sutton. “I want to pay the right taxes. Enough for my business to survive and enough to make an effective contribution to the Canadian economy while we can continue to operate as a company. “

David Brown

David Brown has been working in and writing about the cannabis industry in Canada since 2012. He was previously the editor-in-chief and communications director of Lift Cannabis and Lift News, senior policy advisor for the cannabis legalization division of Health Canada, and is the founder of StratCann Services Inc.

View article by David Brown

By submitting this form, you subscribe to Leafly news and promotional emails and agree to Leafly’s Terms of Use and Privacy Policy. You can unsubscribe from Leafly email messages at any time.

Post a comment: