Inflation is making it harder to start a cannabis business

Inflation hasn’t had a major impact on demand from American marijuana users, but it is having a major impact on cannabis startups — particularly those in newly legalized states.

Start-up costs have increased by 25% to 40%. It’s harder to borrow and harder to build.

A new analysis of market conditions by Whitney Economics finds that startup cannabis operators face a difficult double whammy in 2022: increased borrowing costs and increased construction costs. In other words, it’s more expensive to build a warehouse or processing facility, and it’s more expensive to raise the capital needed to get these projects off the ground.

Those higher start-up costs could slow the expansion of the legal cannabis industry in newly legalized states like New Jersey, New York, Connecticut, and Rhode Island. Consumers may have to wait a little longer for a legal cannabis store to open in their area simply because it costs too much to actually build a cannabis facility.

Rising costs should also impact the number of cannabis jobs created this year. Higher material and labor costs along with higher financing costs mean that 8,300 cannabis-related jobs that may have been created simply won’t exist. If our current inflationary streak extends into next year, up to 18,500 jobs could be affected in 2023.

A reduction in the number of cannabis operations will also affect the number of jobs created. Whitney Economics also forecasts that the impact of higher start-up costs coupled with higher financing costs will reduce cannabis employment opportunities by 8,300 jobs in 2022 and 18,500 jobs in 2023.

Related

The US cannabis industry now supports 428,059 jobs

The start-up costs are 25% to 40% higher than two years ago

A large number of key startup sectors have been hit hard by inflation. what causes it The main culprits are disruptions in the supply chain and higher labor costs.

These higher costs aren’t unique to cannabis startups. But with limited access to funding, cannabis operators are facing a tougher time getting started. Increased construction costs and increased borrowing costs each present a major hurdle for all new businesses, and this is especially true for cannabis startups.

Higher costs mean slower expansion, fewer new jobs

Cannabis supply plays a fundamental role in the success or failure of new legal markets. Without adequate legal access and supply of cannabis, prices will remain artificially high, discouraging consumers from entering the legal market.

As more startups struggle to open their doors, there will be fewer opportunities to access legal cannabis and consumers will continue to rely on the illicit market. This is expected to result in lower sales, limited tax revenues and fewer new jobs.

Related

Inflation continues to rise, but cannabis prices remain the same

As costs increase, illegal market competition increases

Supply, access to legal cannabis, and products priced relatively close to illegal channels are the top three factors in convincing consumers to steer clear of the illegal market. The greater the access, the easier it is to participate legally, as long as the price is competitive with illegal providers.

The data shows that consumers are very price sensitive, but still willing to pay a premium to participate in the legal cannabis market. However, when this premium rises above 10%-15%, the pace of consumer conversion slows down significantly. And inflation is driving up internal operating costs as the price of everything from glass cleaner to toilet paper soars. It’s also putting pressure on margins at existing cannabis stores.

The data also shows that legal cannabis shops keep their prices higher when cannabis access is restricted and demand exceeds supply, with the effect of inadvertently perpetuating the illicit market.

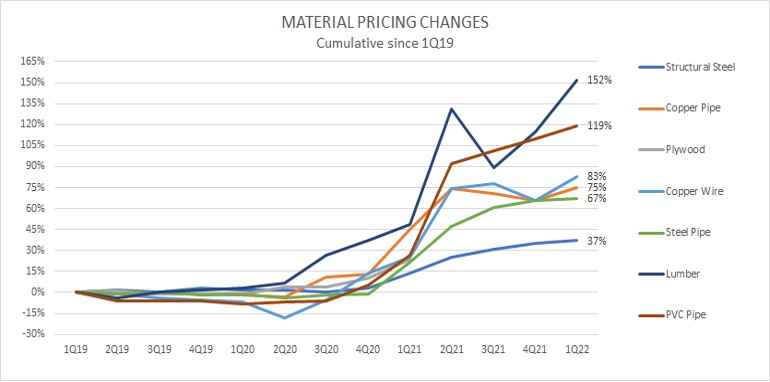

The price of wood: up 152%

The chart below examines building material prices in Portland, Oregon. This is indicative of a trend seen nationwide. Note that there was an initial drop in prices in Covid, but as the pandemic extended and headed into 2021 prices started to skyrocket. This is most clearly exemplified by the price of timber, which has increased by 152% since Q1 2019. The pace of building materials inflation has not yet eased off in 2022.

Construction costs in Portland, Oregon

HVAC costs have gone through the roof

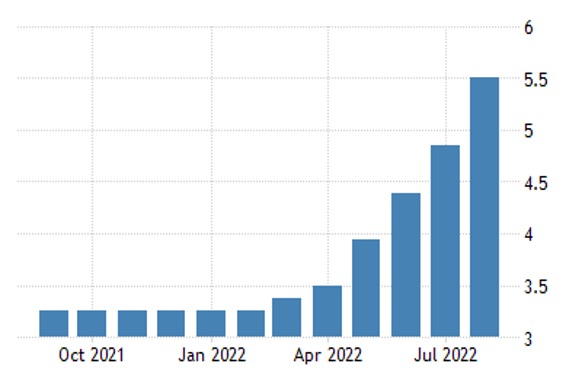

Cannabis processing and retail facilities need to install air management systems, and this too can put cannabis startups out of business. An Arizona HVAC dealer is quoted as saying that if price increases continue, “new air conditioner prices could be up to 56% higher in 2022 by next November.” Interest rates have skyrocketed since 2021 and are expected to continue into 2023.

Air conditioning and commercial refrigeration equipment costs

Investors are looking for distressed assets in mature markets

In mature state markets like Colorado, Washington and Oregon, investors are more inclined to buy distressed assets (and there are many of them) with existing infrastructure rather than build new facilities.

This is also true in developing state markets like California, where some operators have struggled. In a recent business conditions survey conducted by Whitney Economics, only 22% of California respondents said they were profitable.

Buying distressed operations makes it much cheaper for investors to enter these markets than it would be to set up operations in new markets. The downside to buying distressed assets is that they tend to be in markets that are largely oversupplied. These markets are more competitive and therefore offer investors lower margins.

Rising interest rates hurt smaller companies more

In general, a rate hike affects smaller companies more than larger companies. Whether they run a cannabis business or not, small business owners are concerned about higher interest rates.

In a recent survey conducted by Maryland’s Sandy Hill Bank, a majority of business owners cited higher interest rates as a top concern and cited higher interest rates as a top impediment to growing their business.

The costs are even higher for cannabis startups

Cannabis is illegal at the federal level and cannabis companies have limited access to financial services. That means there’s a higher risk premium for cannabis companies compared to other industries. In fact, this risk premium is substantial.

The table below shows that large cannabis multi-state operators pay 10% interest on corporate debt, which is three times the interest rate paid by companies paying 3%. Cannabis startups can expect to borrow money at 21% to 25%, which is seven to eight times what companies were paying in 2021.

| financing | rate | Data Source |

| Corporate debt (excluding cannabis) | 3% | NYU Stern School (2021) |

| Corporate Debt (Large Cannabis MSO) | 10% | Viridian (12/2021) |

| Corporate Debt (Small Cannabis MSO) | fifteen% | Viridian (12/2021) |

| Funding for cannabis startups | 21% – 25% | Whitney Economics (2022) |

Which means a 4% increase in the loan installment for a monthly payment

On a typical $2 million business loan, a 4% interest rate increase equates to $80,000 in additional interest payments per year, which is just over $7,500 per month.

In this case, the $7,500 is not spent on employees, marketing, health insurance, and other aspects of the business. Rising interest rates make survival even more difficult.

Average Monthly Funding Rate, United States

A lower supply could lead to a drop in sales

Rising costs will eventually impact the growth of the U.S. cannabis industry. Whitney Economics predicts that rising costs will lead to a drop in legal sales in 2022, and especially in 2023.

This will not be due to a drop in demand, but rather a drop in supply due to a lack of access to legal cannabis. The overall sales and growth rates in the US will be adversely affected by the limitation of the supply and provision of the licenses. As a result, Whitney Economics is reducing its forecast for US legal market sales in 2022 to US$28.8 billion from US$29.3 billion and to US$33.3 billion in 2023 from US$34.4 billion billion dollars.

Here’s how Congress could help small businesses

To some extent, the impact of high borrowing costs and start-up inflation is inevitable. All businesses, no matter what they sell, face higher costs. But those costs are further compounded by the particular restrictions the cannabis industry faces.

Two measures could really make a difference for cannabis entrepreneurs: SAFE banking and tax reform.

Passing the SAFE Banking Act, currently stalled in Congress, would give legal cannabis companies greater access to financial services. The passage of the reform measure would particularly benefit cannabis companies owned by women and minorities, who are disproportionately affected by the lack of banking services.

Cannabis dealers in the United States currently pay an effective tax rate of 70%. Tax reform, and in particular the reform of IRS code 280E, would significantly reduce operating costs for cannabis retailers, increase legal market participation and increase employment. Lower costs would translate into lower prices and result in faster consumer transition to the legal market.

These are two simple and powerful solutions that are available and have been discussed in Washington, DC for years that could offer lasting relief from the higher costs associated with starting a cannabis business.

Post a comment: