Cannacurio #73: Manufacturing Leaderboards Q1 Late 2023

Be the first to know when new content like this is available!

Subscribe to our newsletter to receive notifications of new posts, local news and industry insights.

Thank you very much! Your submission has been received!

Oops! Something went wrong while submitting the form.

background

Manufacturing licenses are the least vulnerable to cyclical fluctuations when they are issued. There are currently just over 6,200 manufacturing licenses in the Cannabiz Media License Database across 5,800 facilities. Cannabiz Media categorizes a license as a producer if it fits the following description: The license is for processing (manufacturing) marijuana-infused products such as edibles or concentrates, but does not include cultivation or retail sale to customers.

Important Findings

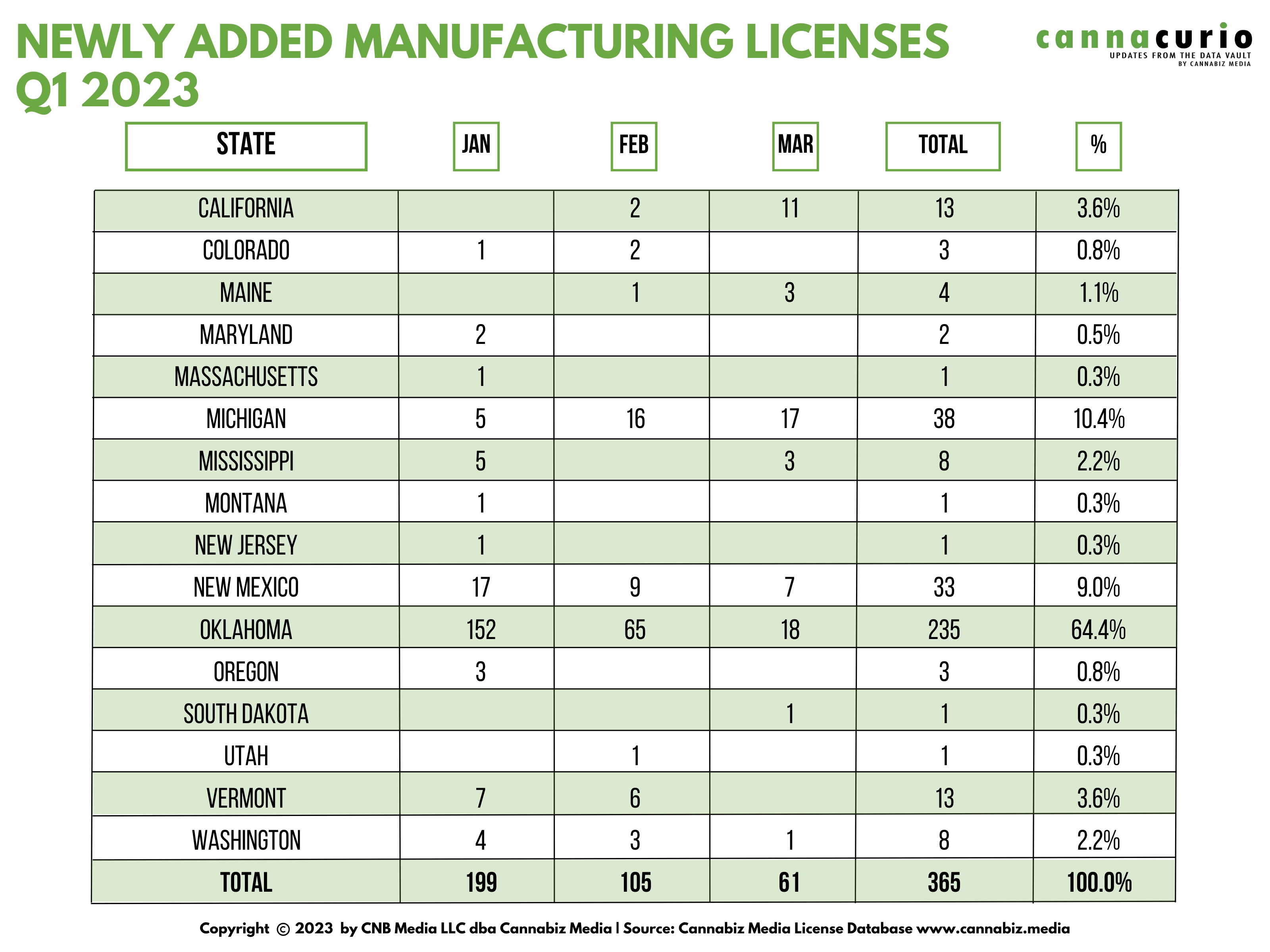

- Only 16 states issued manufacturing licenses in the first quarter of 2023.

- Oklahoma led the statewide in newly issued manufacturing licenses with 338 (54%).

- Expanding programs such as Vermont, Mississippi and New York also contributed in the first quarter.

- 84% of new licenses came from three states: Oklahoma, Michigan and New Mexico.

In the first quarter of 2023, we only tracked 16 states that issued new manufacturing licenses, and most came from a few states, with Oklahoma accounting for 64% of them, although only 18 new licenses were issued in March.

The following time series shows a slight upward trend, which was certainly supported by the large January cohort from Oklahoma:

leaderboards

Here is the ranking comparing year-end 2022 to Q1 2023. There was again a slight increase in licenses, driven by Oklahoma. If we remove the number of Oklahoma licenses as shown below, we see that the statewide ranking would only have increased by nine licenses!

Diploma

Licensed cannabis producers aren’t immune to the challenges the industry is facing. These include more consolidation and rationalization processes, falling prices in saturated markets, high interest rates and challenges in raising capital, and formerly limited licensing states expanding license numbers. The unlicensed market continues to have an outsized impact on the entire licensing value chain.

There are more states moving towards new or expanded programs that may create more production in certain markets. However, given the cost of equipment, licensing moratoriums, and economic headwinds, I don’t expect many new licenses to be issued in the second quarter.

author

Ed Keating is co-founder of Cannabiz Media and oversees the company’s data research and government relations efforts. He has spent his career working with and advising information companies on compliance issues. Ed has led product, marketing and sales while overseeing complex, multi-jurisdictional product lines in the securities, corporate, UCC, security, environmental and human resources markets.

At Cannabiz Media, Ed enjoys the challenge of working with regulators around the world as he and his team gather corporate, financial and licensing information to track the people, products and companies in the cannabis economy.

Ed graduated from Hamilton College and received his MBA from the Kellogg School at Northwestern University.

Cannabiz Media customers can stay up to date on these and other new licenses through our newsletter, notification and reporting modules. Subscribe to our newsletter to get these weekly reports in your inbox. Or you can schedule a demo to learn more about how to access the Cannabiz media license database yourself to dig deeper into this data.

Cannacurio is a weekly column from Cannabiz Media featuring insights from the most comprehensive licensing data platform. Check out Cannacurio’s posts and podcasts for the latest updates and information.

Post a comment: